As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

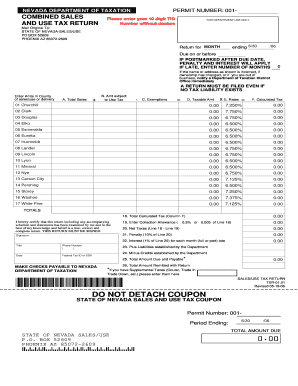

Goodsprings, Nevada Sales Tax Rate - Avalara

The minimum combined 2020 sales tax rate for Goodsprings, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The Clark County sales tax rate is %. The Goodsprings sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.Sales tax increase passed by Clark County Commission

Sep 04, 2019 · Posted at 1:45 PM, Sep 03, 2019 and last updated 2019-09-04 21:36:00-04 LAS VEGAS (KTNV) — Clark County commissioners passed a sales tax increase with a 5-2 vote Tuesday morning.Sales tax calculator for Nevada, United States in 2020

The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate (0% to 0.25%).Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada State Department of Taxation Department of Taxation Home Page

Solved: What is total sales tax rate for nevada

Jun 06, 2019 · The combined 2019 clark county nv sales tax rate sales tax rate for Las Vegas, NV is 8.25%.This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%.The Clark County, sales tax rate…Taxes and fees: Where marijuana money is going in Nevada ...

Jun 10, 2019 · In fiscal year 2019, which will end June 30, the county received $9.7 million in business license fees — already higher than the amount generated in fiscal year 2018, which was $9.4 million.The Nye County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Nye County local sales taxes.The local sales tax consists 2019 clark county nv sales tax rate of a 3.00% county sales tax.. The Nye County Sales Tax is collected by the merchant on all qualifying sales made within Nye County; Groceries are exempt from the Nye County and Nevada state sales taxes; Nye County collects a 3% local sales ...

Residents of Clark County pay a flat county income tax of 2.00% on earned income, in addition to the Indiana income tax and the Federal income tax.. Nonresidents who work in Clark County pay a local income tax of 0.75%, which is 1.25% lower than the local income tax paid by residents.

Sales tax calculator for 89117 Las Vegas, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89117. The 89117, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 2019 clark county nv sales tax rate 89117's county rate (3.775%). Rate variationRECENT POSTS:

- louis vuitton padlock necklace mens

- louisiana state fair 2019 food

- speedy 35 epi reddit

- black and white louis vuitton bookbag

- zip codes st louis park mn

- macy's clearance center union city

- epi louis vuitton speedy

- louis vuitton blooming flowers wallet

- leather long wallet mens

- gumtree sailing boats for sale uk

- cheap lv fanny pack

- is buying a louis vuitton bag worth it

- louis vuitton looting portland oregon area

- st louis cardinals projected pitching rotation