As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Ohio Foreclosures and Tax Lien Sales Search Directory

View Preble County information about current Sheriff mortgage foreclosure sales and tax foreclosure sales. Return to Top Putnam CountyTaxes - Henderson

Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada State Department of Taxation Department of Taxation Home Page Clark County Assessor (Property Tax information) Assessor Home PageJan 15, clark county sales tax 2020 · Georgia saw a small decrease in its average local rates, but it continues to levy the 19 th highest combined sales taxes. Johnson County’s special purpose local option sales tax (SPLOST) expired in September, taking the county’s combined sales tax down from 8 percent to 7 percent.

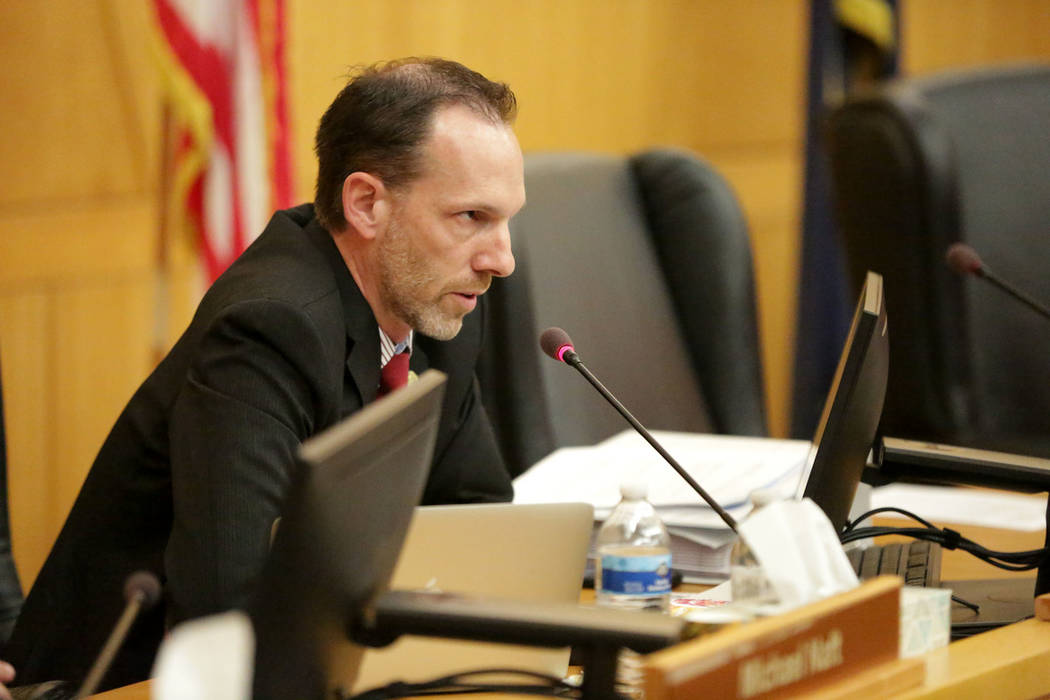

Sales tax increase passed by Clark County Commission

Sep 04, 2019 · LAS VEGAS (KTNV) — Clark County commissioners passed a sales tax increase with a 5-2 vote Tuesday morning. The funds collected from the one-eighth of a cent tax …Nov 13, 2020 · The preliminary listing in June had nearly 1,200 parcels with such past due taxes, and was reduced to 219 parcels by the day of the tax sale, said Clark County Treasurer David Reinhardt. Of those ...

Treasurer | Clark County WI

The Clark County Treasurer's office operates under the rules and regulations stated in the Wisconsin Statutes as well as the County Board and Wisconsin Department of Revenue. The treasurer is a member clark county sales tax of the Wisconsin County Treasurer's Association and the Wisconsin Real Property Listers Association.Sep 03, 2019 · The tax increase will take the sales tax in Clark County from 8.25 percent to 8.375 percent. The bill allows money to be used to address homelessness, prevent truancy and chronic absenteeism in school, promote early childhood education, affordable housing, workforce development, and aid in recruitment and retaining teachers in high-risk schools.

Clark County Tax Lien Sales. Auctions are normally held in the spring. However, there may be an additional auction in the fall. Information regarding the auctions will be posted on the county’s website and will also be available by calling the Clark County Treasurer’s office.

As of September 30, Clark County, IL shows 11 tax liens. Interested in a tax lien in Clark County, IL? How does a tax lien sale work? When a Clark County, IL tax clark county sales tax lien is issued for unpaid, past due balances, Clark County, IL creates a tax-lien certificate that includes the amount of the taxes … 1970 louis vuitton speedy 301

RECENT POSTS:

- louis vuitton neverfull mm costume

- city nails lake st louis

- palm springs backpack mm vs pm

- louis vuitton durham nc phone

- st louis cardinals score espn

- gist rodeo belt buckles

- louis vuitton pochette milla pm

- red leather tote bag for sale ebay

- lv print fabric uk

- replace zipper louis vuitton purse

- how to spot a fake louis vuitton coin purse

- desert hills premium outlets los angeles

- small sling backpack for school

- man fanny pack crossbody