As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

$13,680.00 (reduced value) x 1.1% (current RTA excise tax rate) = $150.00 clark county washington sales tax rate 2019 due This method of calculating the tax ensures that owners of the same type of vehicle pay the same amount of tax. The …

Ohio Sales Tax Rates By City & County 2020

Ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%.There are a total of 553 local tax jurisdictions across the state, collecting an average local tax of 1.41%. Click here for a larger sales tax map, or here for a sales tax table.. Combined with the state sales tax, the highest sales tax rate …Exceptions to the county tax treatment and special situations are explained in Part 18.D.(2) through (5) in Publication 201, Wisconsin Sales and Use Tax Information. Retailers who make sales subject to the 0.5% county tax must collect 5.5% sales tax on their retail sales: 5% state sales tax, and; 0.5% county sales tax.

Clark County Treasurer's Tax Rate By District

CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. There are currently 111 separate tax districts in Clark County. The tax rate for each district is based on the …Property value is assessed by the Clark County Assessor’s Office and property taxes are collected by the Clark County Treasurer. Sales Tax. All sales within the City of Battle Ground are subject to a sales tax rate of 8.4%. Sales and use tax are collected by the WA …

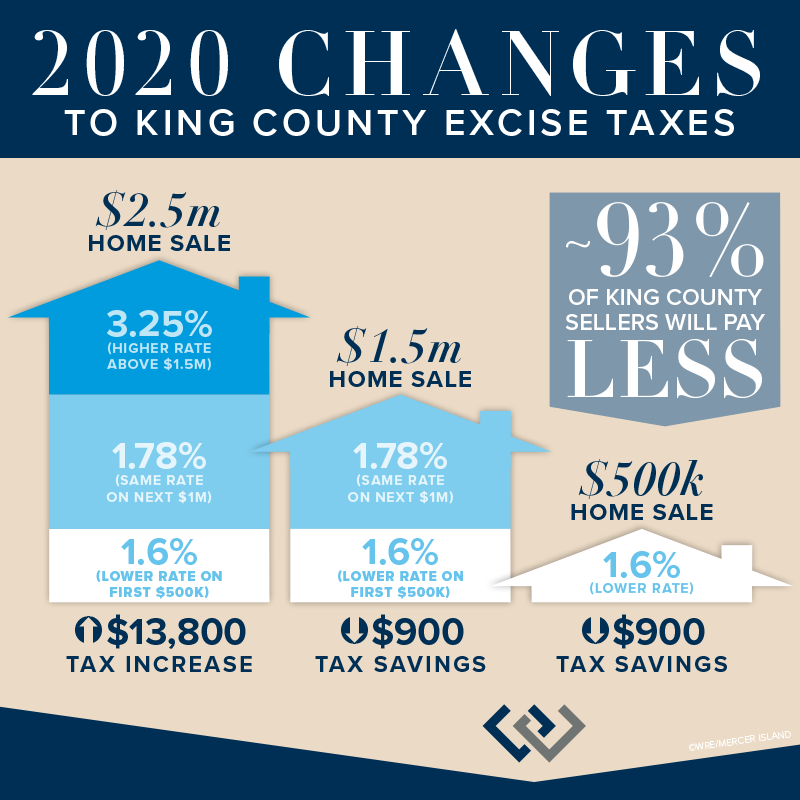

Sep 16, 2019 · Updated 9/18/2019, 9:15 PM What Changed? The Washington legislature recently enacted legislation that dramatically changes aspects of the state’s Real Estate Excise Tax (REET). Unless real property is classified as timberland or agricultural land, the REET clark county washington sales tax rate 2019 rate structure will be changing on January 1, 2020. The current flat rate … louis vuitton leather repair near memphis

Shoppers, say goodbye to sales tax exemption - literacybasics.ca

Apr 29, 2019 · The Washington sales tax is 6.5 percent. There will be no reimbursement for local sales taxes. A state revenue department spokeswoman said further details have yet to be worked out.2019 Mental Health Sales Tax Funding Grant Awards, Clark ...

NOTICE. Clark County is soliciting proposals for: . Request for Proposal #743 2019 Mental Health Sales Tax Funding Grant Awards The Request for Proposal documents are available to view at:Sep 03, 2019 · The tax increase will take the sales tax in Clark County from 8.25 percent to 8.375 percent. The bill allows money to be used to address homelessness, prevent truancy and chronic …

RECENT POSTS:

- macy's clearance furniture garden city

- lv belts lvmbelts-3493

- lv murakami cherry blossom bag

- macy's jewelry sale diamond earrings

- louis vuitton empreinte montaigne bb marine rouge

- when is amazon uk black friday 2019

- louis vuitton 2020 christmas packaging

- louis vuitton stencil template

- chef louis little mermaid 2

- lv bags from japan

- lv epi leather wallet review

- louis vuitton speedy 25 b images

- louis vuitton copley boston hours

- captured lv promo code