As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

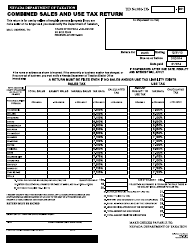

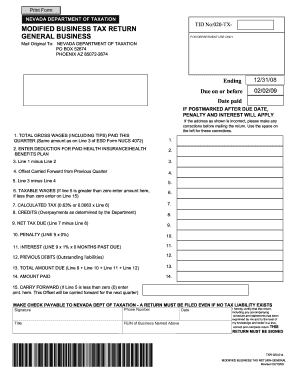

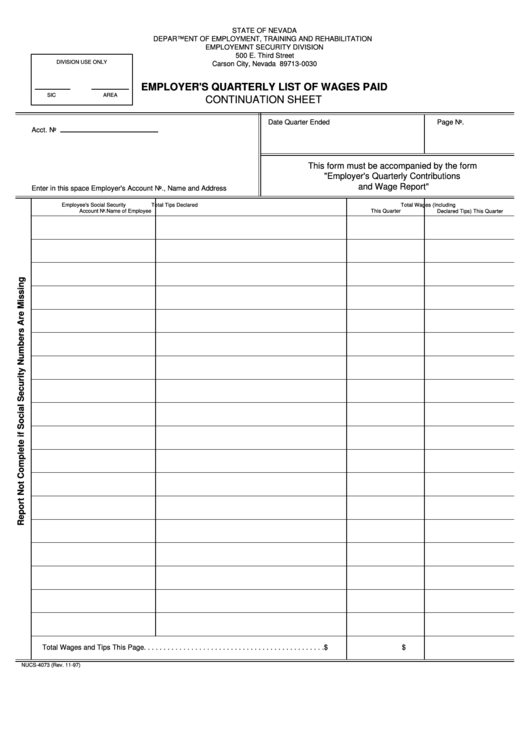

NEVADA - Where to File Addresses Taxpayers and Tax ...

Jan 08, 2020 · These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in Nevada during Calendar Year 2020. If you live in NEVADA ... and you are filing a Form …Nevada Business Taxes & Sales Tax for LLCs

Get details on the Nevada sales tax online here. Nevada Sales Tax Rates. Sales tax rates do vary between states, counties and cities. forms nevada sales tax Typically, the state will set a base sales tax rate, then specific counties and cities may levy small additional sales tax amounts on top of that. Federal Taxes for Your Nevada LLC: Self-Employment and Income Taxes01-797, 2018 Worksheet for Completing the Sales and Use Tax Return Form 01-117 (PDF) Refund Forms. Sales forms nevada sales tax Tax Refund Instructions (PDF) 00-985, Assignment of Right to Refund (PDF) 01-136, Credit …

Jul 29, 2020 · When calculating the sales tax for this purchase, Steve applies the 4.6% state tax rate for Nevada plus 3.55% for Clark county’s tax rate. At a total sales tax rate of 8.15%, the total cost is $378.53 ($28.53 sales tax). Out-of-state Sales. Nevada businesses only need to pay sales tax on out-of-state sales …

How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada …

Submit this form electronically, or print and forward with any additional documentation to: Nevada Department of Taxation Investigations, 2550 Paseo Verde Pkwy, #180, Henderson NV 89074. E-mail with any attachments to www.bagssaleusa.com…

Nevada is a member of the Streamlined Sales and Use Tax Agreement (SSUTA), which means it follows certain rules regarding how its sales tax laws and registration processes are structured. It also means that you can register for a Nevada Sales Tax …

I sincerely hope you enjoy your experience with Nevada Tax Center. Warm regards, Melanie About the Department. The Department administers the collection and distribution of more than $6 billion annually in state and local government revenue from 17 different taxes. The revenue collected by the Department funds all levels of government in Nevada ...

Jan 27, 2020 · Nevada Tax Forms 2019. Printable State Income Tax Forms and Instructions. Nevada is one of seven states which do not levy a personal income tax. Nevada forms nevada sales tax state and local governments generate revenue primarily from sales tax and property tax. Residents of Nevada must still file federal Form 1040 or Form … louis vuitton outlet

RECENT POSTS:

- best high end purse for travel in europe

- louis philippe formal suits

- louis vuitton belt white mens

- custom printed cotton canvas bags

- louis vuitton siena mm

- louis vuitton purses new orleans law

- indoor photography locations st louis mo

- hermes birkin bag 30 orange

- how to clean inside lining of louis vuitton bag

- louis vuitton mother's day ecard

- louis vuitton black epi sac d'epaule

- speedy bandouliere damier size 305

- authentic louis vuitton monogram speedy 30

- zack backpack louis vuitton