As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)

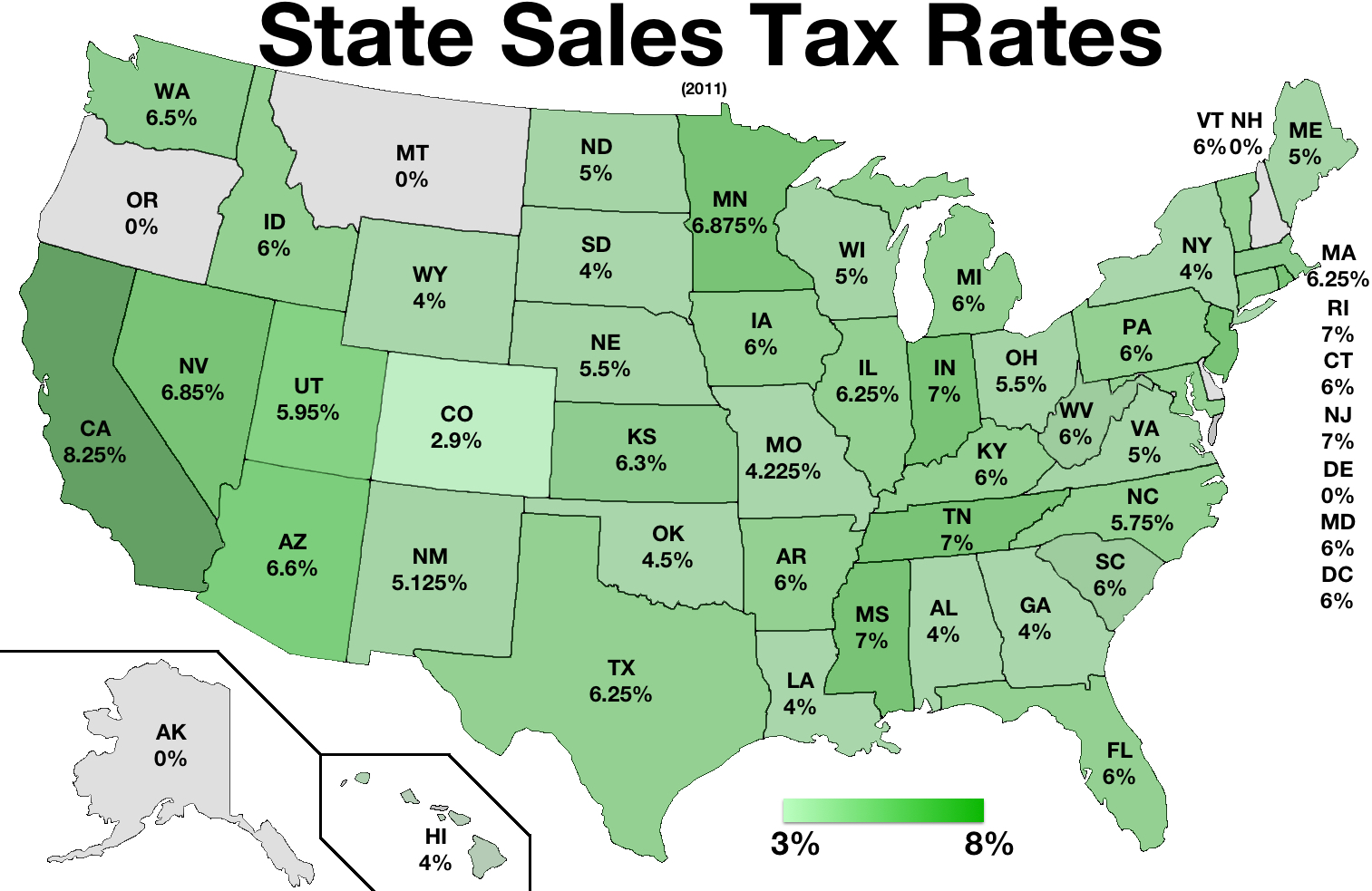

The Clark County, Nevada Local Sales Tax Rate is a minimum ...

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Nevada has a 4.6% sales tax and Clark County collects internet sales tax rate nevada an additional 3.775%, so the minimum sales tax rate in Clark County is 8.375% (not including any city or special district taxes). This table shows the total sales tax rates …Sales Tax 101 for Online Sellers - TurboTax Tax Tips & Videos

For example, in California, the statewide sales tax rate was 7.25% in 2020, and local districts can impose their own additional sales taxes. A seller must know the local tax rates and collect them from his or her customers. Many states that collect sales tax …What The Supreme Court's Internet Sales Tax Ruling Says ...

Jun 22, 2018 · The U.S. Supreme Court's landmark ruling allows states to ask online retailers to collect internet sales tax, leveling the playing field between online and physical retailers. But it also means ...State and Local Sales Tax Rates, 2019 | Tax Foundation

Jan 30, 2019 · The District of Columbia’s sales tax rate increased to 6 percent from 5.75 percent. internet sales tax rate nevada Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate …NEVADA. NO sales tax will be charged for bullion or coins used as a medium of exchange as they are exempt from sales tax when shipping to a Nevada address. The state of Nevada does require the collection of sales taxes on some products sold by BGASC and delivered to a Nevada …

State Sales Tax Rates - Sales Tax Institute

Nov 01, 2020 · 0% – 2.5% Some local jurisdictions do not impose a sales tax. Yes. Nevada: 6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate …Note: Nevada has no state income tax. Only the Federal Income Tax applies.. Nevada is one of seven states that do not collect a personal income tax. However, revenue lost to Nevada by not having a personal income tax may be made up through other state-level taxes, such as the Nevada sales tax and the Nevada property tax.. Nevada has no personal income tax or corporate income tax.

Does Nevada Have a Sales Tax? | Bizfluent

Mar 28, 2019 · The Nevada internet sales tax rate nevada sales tax has been around since the 1950s. In 1955, it was established at 2 percent. In 2013, it reached 8.1 percent. Currently, it ranges between 6.68 percent and 8.26 percent.In 2018, Internet-based retailers and other remote sellers became subject to this tax, too. Those who exceed $100,000 in sales or 200 transactions in the previous or current year are required to collect sales ...The Nebraska state sales and use tax rate is 5.5% (.055). , Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1, 2021 Updated 09/03/2020 Effective January 1, 2021, the local sales and use tax rates …

RECENT POSTS:

- louis vuitton city pouch monogram

- louis vuitton keepall 50 blue

- sunshine crossbody bag tutorial

- used louis vuitton men hand luggage

- tignanello handbags crossbody bags

- louis vuitton westchester mall hours

- louis vuitton small bag with gold chainsaw

- louis vuitton hong kong harbour city

- louis vuitton men's multiple wallet reviewed

- wholesale name brand designer handbags

- lv nano speedy dupe

- is october 12 2020 a holiday

- nordstrom crossbody bags tory burch

- louis vuitton speedy 35 damier with strap