As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

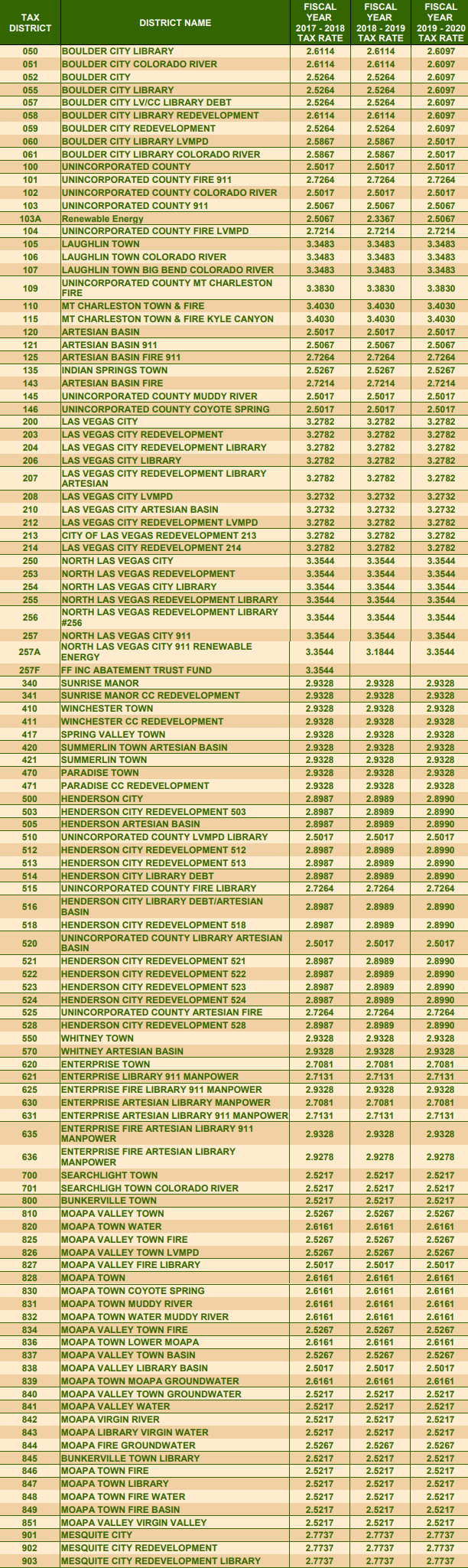

Nevada Income Tax Rates for 2020

The Nevada income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2020. Detailed Nevada state income tax rates and brackets are available on this page. www.semadata.org – The 2019 Tax ResourceYear-End Summary for 2018 Historical Visitation Statistics: 1970-2019 A historical review of key Las Vegas tourism indicators from 1970 to present.

Clark County approves raising sales tax 1/8 of a cent ...

Sep 03, 2019 · Michael Lyle (MJ to some) has been a journalist in Las Vegas for eight years. He started his career at View Neighborhood las vegas nevada sales tax rate 2018 News, the community edition of the Las Vegas Review-Journal.During his seven years with the R-J, he won several first place awards from the Nevada Press Association and was named its 2011 Journalist of Merit.He left the paper in 2017 and spent a year as a freelance ...EstateSales.NET provides detailed descriptions, pictures, and directions to local estate sales, tag sales, and auctions in the Las Vegas area as well as the entire state of NV.

How are Property Taxes Calculated? - Las Vegas Homes for Sale

The tax rate for homes in Las Vegas is $3.3002 per hundred of assessed value. To determine the assessed value, multiply the taxable value of the home ($100,000) by the assessment ratio (35%): $100,000 las vegas nevada sales tax rate 2018 X .35 = $35,000 assessed value To calculate the tax, multiply the assessed value by the tax rate ($3.3002 per hundred dollars assessed value). lv club loaferHow to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is las vegas nevada sales tax rate 2018 7.5 percent, you would multiply 5000 by .075.Taxes in Nevada. Each state’s tax code is a multifaceted system with many moving parts, and Nevada is no exception. The first step towards understanding Nevada’s tax code is knowing the basics. How does Nevada rank? Below, we have highlighted a number of tax rates, ranks, and measures detailing Nevada’s income tax, business tax, sales tax, and property tax systems.

Zillow has 7,501 homes for sale in Las Vegas NV. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place.

Carson City Department of Taxation 1550 College Parkway Suite 115 Carson City, Nevada 89706 (775) 684-2000 (voice) (775) 684-2020 (fax)

RECENT POSTS:

- lv mini palm springs backpack review

- black and white louis vuitton sandals

- louis vuitton pochette accessoires damier mini

- supreme louis vuitton hoodie black and white

- anti-theft crossbody bag with usb charging portable

- ralph lauren outlet store in new york city

- lv twin pochette gm size

- lv initiales 40mm reversible belt black

- hermes evelyne bag black

- louis vuitton black epi business card

- louis v mens shoulder bag

- louis vuitton mens.wallet

- siena lv website

- grey patent leather tote bag