As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

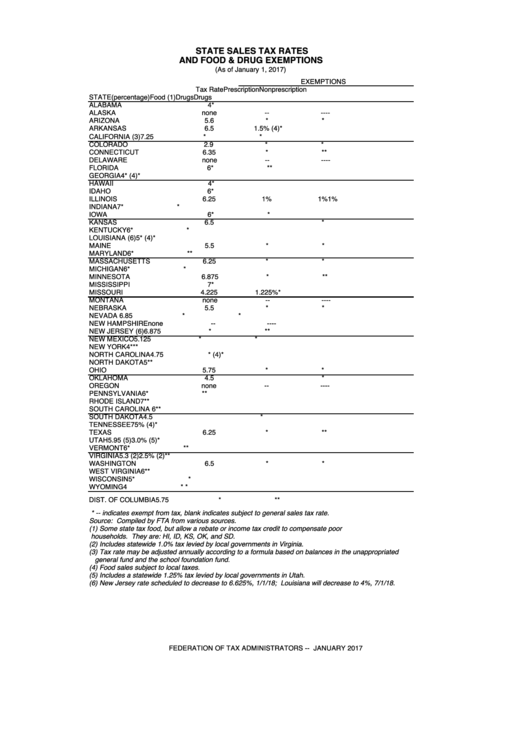

Aug 19, 2018 · Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation. Nevada State Sales Tax The general sales tax rate in Nevada is 6.85 percent statewide, but it does vary by county, as some impose a local sales tax …

Oct 01, 2020 · Some communities located within a county or a city may not be listed. If you are in doubt about the correct rate or if you cannot find a community, please call our toll-free number at 1-800-400-7115 (CRS:711), or call the local California Department nevada county california sales tax rate of Tax …

State Sales Tax Rates - Sales Tax Institute

Some local jurisdictions do not impose a sales tax. Yes. California: 7.250% Note that the true California state sales tax rate is 6%. There is a statewide county tax of 1.25% and therefore, the lowest rate anywhere in California is 7.25%. We have listed the combined state/county rate as the state rate …Sales & Use Tax Forms - Nevada

Effective January 1, 2020 the Clark County sales and use tax rate increased to 8.375%. This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable. The 2011 Legislation Session pursuant to AB 504, reduced the interest rate …Nevada County, CA Recently Sold Homes - 0

Recently Sold Homes in Nevada County, CA have a median listing price of $499,000 and a price per square foot of $310. There are 1,733 active recently sold homes in Nevada County, California, which ...Sales Tax Information & FAQ's - Nevada

If proof cannot be provided, Use Tax must be paid to Nevada. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. NAC 372.055, NRS 372.185. Do I have to pay Nevada Sales Tax when I purchase a boat? Yes, if the boat is purchased for use or storage in Nevada.Record number of California cities approve general sales ...

Nov 07, 2020 · Voters in 24 California cities approved taxes on cannabis businesses out of 26 such measures on the ballot. That includes Marysville in Yuba County and Grass Valley in Nevada County.Example: You live and run your business in Las Vegas, NV 89165 which nevada county california sales tax rate has a sales tax rate of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in Nevada

Car Sales Tax & Tags Calculator by State | DMV.ORG

NOTE: Not ALL STATES offer a tax and tags calculator. (See below for states that do and don't offer these services.) In addition, CarMax offers a free tax and tag calculator for some states only. This nevada county california sales tax rate calculator can help you estimate the taxes …RECENT POSTS:

- speedy 3000 laser

- mens louis vuitton backpack cheap

- new lv sneakers 2019

- world market dining furniture sale

- burberry ashby canvas bucket bag

- how much does louis vuitton make a month

- is louis vuitton cheap in singapore

- lv alma epi pm price

- louis vuitton small leather goods canada

- solo backpack sprayer replacement straps

- lv galliera pm vs gm

- portrait artist st louis mo

- best price herschel backpack

- menards black friday 2019 sale ad