As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Jefferson City, MO 65105-3380. Sales Tax Rate Questions: nrd.kbic-nsn.gov Send keyboard focus to media. Composite Map . The composite map shows all the special tax jurisdictions in the state. If you click on an area you can arrow through the pop-ups to view each districts' tax rates. You cannot add the rates …

Aug 07, 2019 · Tuesday’s half-cent sales tax ballot measure was approved by 89 percent of voters. Nevada Regional Medical Center (NRMC) is located in southwest Missouri’s Vernon County (2019 file …

[3] State levied lodging tax varies. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 3.0% and 6.0% for hotels with more than 160 rooms. All other hotels with 81-160 rooms is 1.5% and 5.0% for hotels with more than 160 rooms. [4] Specific sales tax levied on accommodations. State has no general sales tax.

Best States for Low Taxes: 50 States Ranked for Taxes ...

Dec 27, 2019 · The Tar Heel State has been shaking up its tax structure, switching out graduated income tax brackets for a flat tax and capturing more services with its sales tax. The tax rate for 2018 ws …Car Tax by State | USA | Manual Car Sales Tax Calculator

Pamphlet 62: Select View Sales Rates and Taxes, then select city, nevada mo sales tax rate and add percentages for total sales tax rate.(Exp) Denver: 8.31% Connecticut: 6.35% for vehicle $50k or less louis vuitton monogram su. trunk brown canvas walletNevada's state sales tax rate is 6.85%. Counties may impose additional rates via voter approval or through approval of the legislature; therefore, the applicable sales tax will vary by county from 6.85% to …

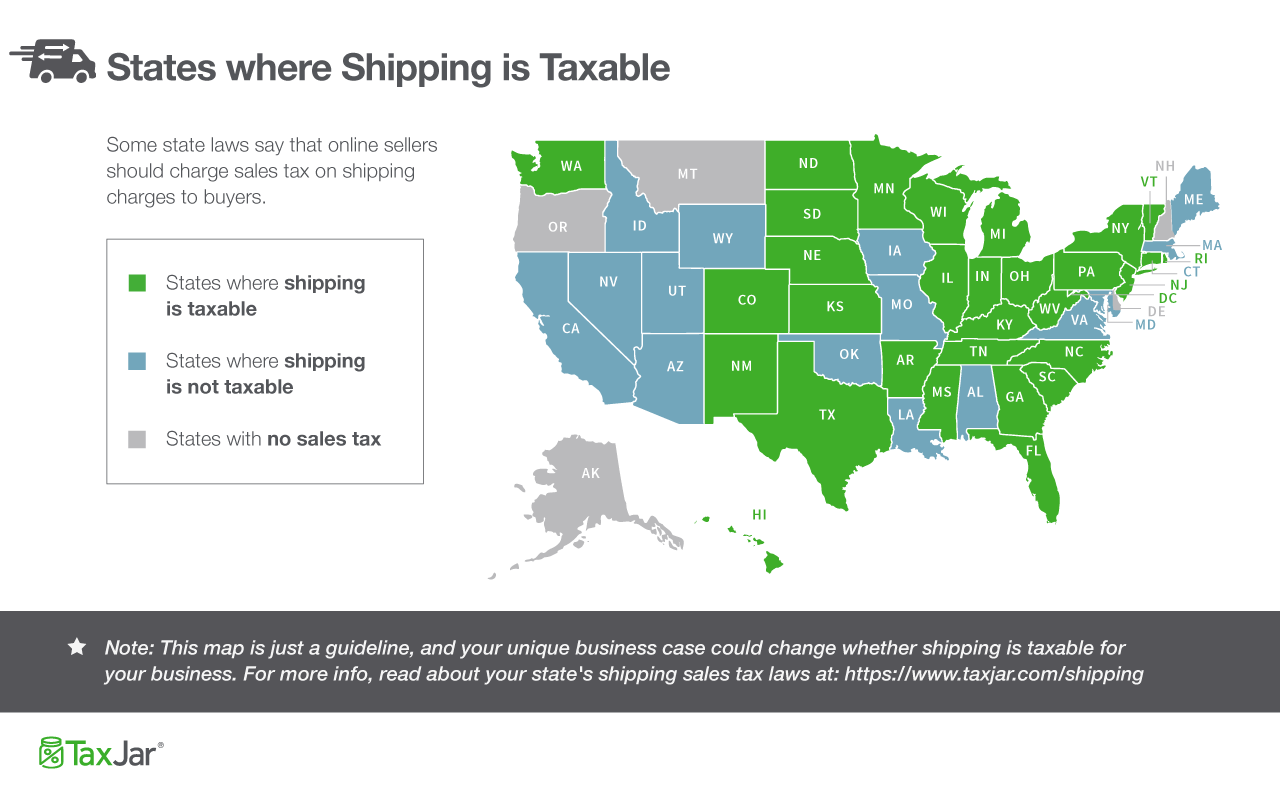

If you live in one of the “origin-based” sales tax states, charge the rate at your business location. You can look this rate up with TaxJar’s Sales Tax Calculator. Note: If you do NOT have a location in a state, our accounting advisors recommend taking an average of the sales tax rates …

Missouri (MO) Tax Lien Sales | misuniversity

In Missouri, county treasurer’s and tax collector’s sell tax lien certificates to the winning bidder at the delinquent property tax lien sales. Tax Sale Type: Tax Lien nevada mo sales tax rate Certificate (Sec. 140.290). Contact: Tax …How Are Groceries, Candy, and Soda Taxed in Your State?

While 32 states exempt groceries, six additional states (Arkansas, Illinois, Missouri, Tennessee, Utah, and Virginia) tax groceries at a lower, preferential rate. Four of those six states include both candy and soda in the rate nevada mo sales tax rate …RECENT POSTS:

- louisiana lottery powerball results drawing

- scotts speedy green 1000 parts diagram

- louis vuitton keyring price

- lewis drug sioux falls sd black friday ad

- louis vuitton bone ' black purse crossbody bag

- christmas 2020 holidays uk

- authentic louis vuitton handbag repair

- louis vuitton neverfull mm monogram printable

- louis vuitton us corporate office

- bean bags for children's room

- vintage louis vuitton cherry bag

- extra large canvas duffle bags

- louis vuitton popsocket goldsboro nc

- louis vuitton twist pm