As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

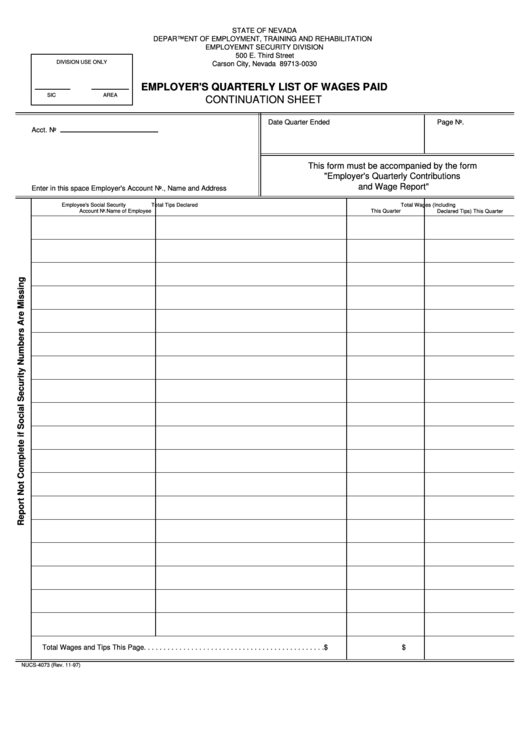

Nevada Sales Tax Information, Sales Tax Rates, and Deadlines

Nevada is a member of the Streamlined Sales and Use Tax Agreement (SSUTA), which means it follows certain rules regarding how its sales tax laws and registration processes are structured. It also means that you can register for a Nevada Sales Tax …I sincerely hope you enjoy your experience with Nevada Tax Center. Warm regards, Melanie About the Department. The Department administers the collection and distribution of more than $6 billion annually in state and local government nevada sales tax forms revenue from 17 different taxes. The revenue collected by the Department funds all levels of government in Nevada ...

A summary of Nevada laws and IFTA requirements on record keeping. IFTA Tax Returns. File and pay your Nevada IFTA tax return online. If you do not have an online IFTA account, contact www.semadata.org Quarterly IFTA Fuel Tax Rates; Nevada IFTA Tax Return (MC 366 & MC 366a) For filing quarterly Fuel Tax …

“The sales price of any item sold through this machine includes nevada sales tax forms applicable Nevada State and Local Sales Taxes.” [Tax Comm’n, Combined Sales and Use Tax Ruling part No. 25, eff. 6-14-68] NAC 372.530 …

How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada …

SilverFlume Nevada's Business Portal first stop to start and manage your business in Nevada, including new business checklist, Nevada LLC Digital Operating Agreement, real-time online entity formation, State Business License, Initial List, Annual List, State Business License renewal, Sales & Use Tax …

New Rules on Collecting Sales Tax for Remote Sellers. Effective October 1, 2018, remote sellers whose sales in Nevada exceed certain thresholds must collect sales tax. Remote sellers are any sellers, including online retailers, who don’t have a physical presence in Nevada and are not otherwise required to register or collect sales tax in Nevada.

Nevada Department of Taxation - Nevada Tax Center

a service of the Nevada Department of Taxation. Home; How-To Videos; FAQ; About; Contact Us; Log In; Sign Up; JavaScript is required louis vuitton cup watchdog case briefNevada State Taxes: Everything You Need to Know ...

Aug nevada sales tax forms 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax …RECENT POSTS:

- trendy clothing wholesale suppliers

- louis vuitton women's suit

- lv supreme hoodie buy

- louis vuitton purse monogram and pink

- supreme lv shoulder bag stockx

- louis vuitton trainer yupoo

- kanye west louis vuitton trainers

- lv bum bag monogram black

- mini crossbody bag cell phone wallet

- louis vuitton fanny pack fake

- lv on the go gm size chart

- louis vuitton cluny mm vs bb

- louis vuitton neverfull brand new

- speedy b 25 or alma bb