As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

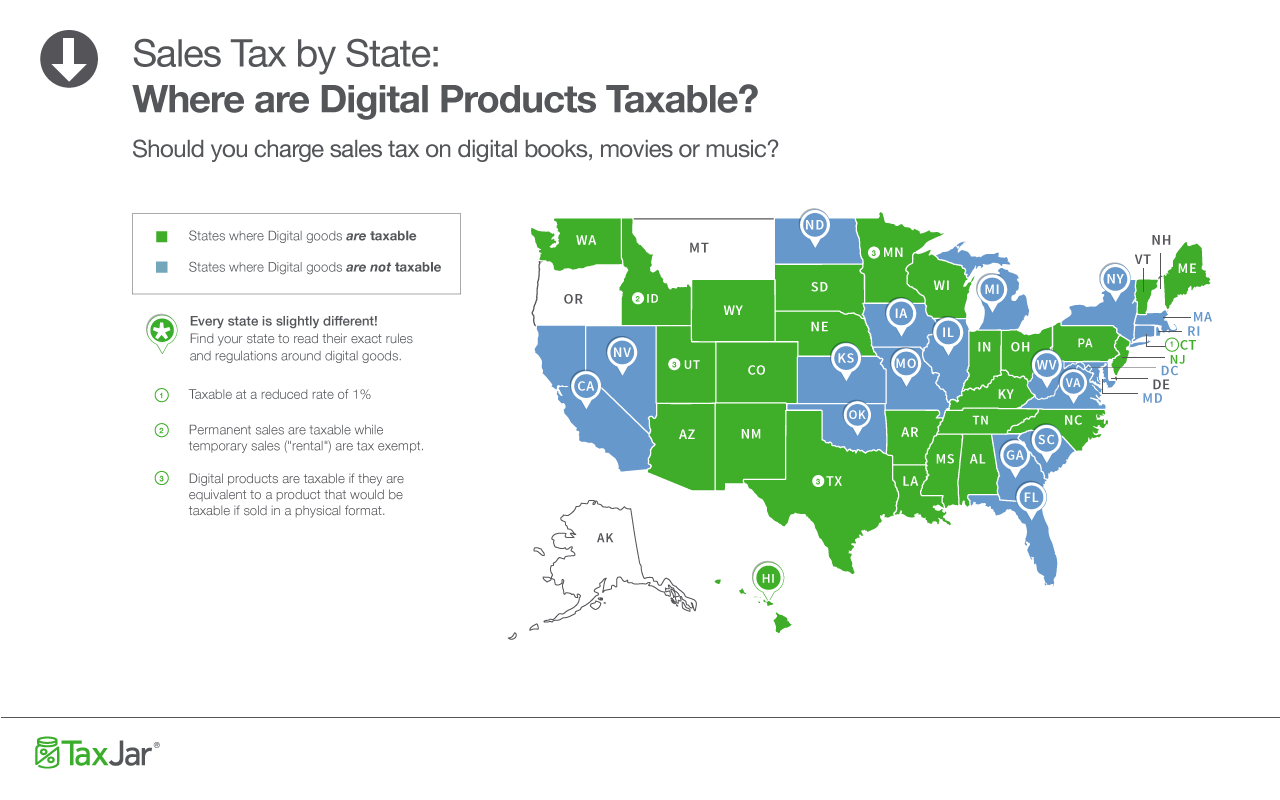

Sales tax calculator for 89109 Las Vegas, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89109. The 89109, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89109's county rate (3.775%). Rate variationNevada Sales Tax Exemptions | Agile Consulting Group

The state of Nevada levies a 4.6% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes between 2.25% and 3.55%. The range of total sales tax rates within the state of Nevada is between 6.85% and 8.15%.The Lyon County, Nevada sales tax is 7.10%, consisting of 4.60% Nevada state sales tax and 2.50% Lyon County local sales taxes.The local sales tax consists of a 2.50% county sales tax.. The Lyon County Sales Tax is collected by the merchant on all qualifying sales made within Lyon County; Groceries are exempt from the Lyon County and Nevada state sales taxes

Do I have to pay sales tax in Nevada when I buy a used car ...

Nov 03, 2018 · Interestingly, when buying a T-shirt in Nevada, or anywhere else for that matter, one is subject to the local and state taxes where the purchase is made. (Presently we have no federal sales tax or VAT.) But when one purchases an automobile, that p...State Sales Tax Rates - Sales Tax Institute

Nov 01, 2020 · State State Rate Range of Local Rates Local Rates Apply to Use Tax; Alabama: 4.000%. 0% – 9.0% Some local jurisdictions do not impose a sales tax.. Yes/No Some of the cities and counties do apply use tax. Alaska: 0.000%. 0% – 7.85% A cap on the local sales/use tax applies on sales of any item of tangible personal property. Some local jurisdictions do not impose a sales tax. louis vuitton monogram canvas neverfull gm bagFree calculator to find any value given the other two of the following three: before tax price, sales tax rate, and after-tax price. Also, check the sales tax rates in different states of the U.S., understand the forms of nevada sales tax rate 2018 sales taxes used in different regions of the world, or explore hundreds of other calculators addressing topics such as finance, math, fitness, health, and many more.

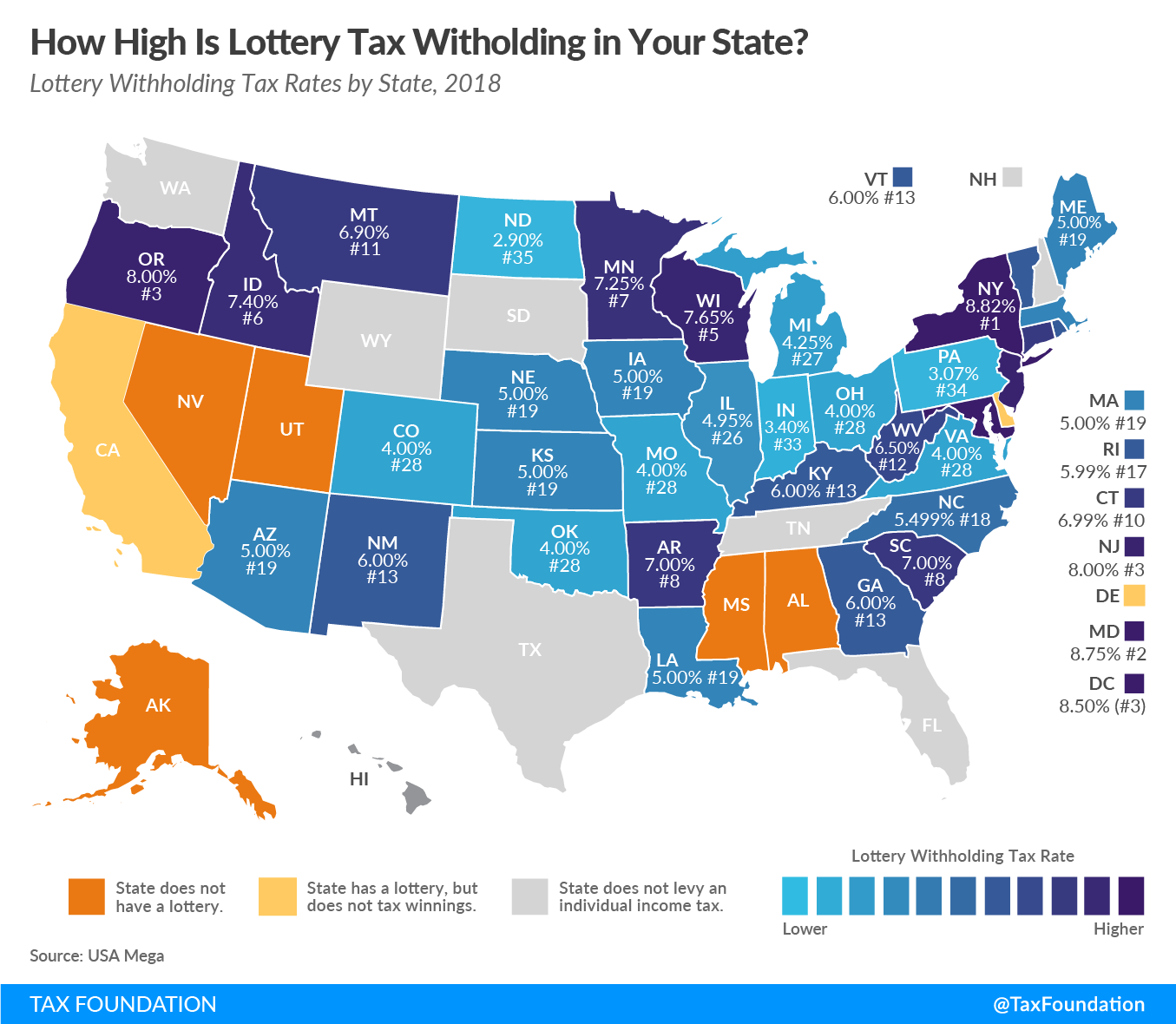

Nevada Tax Rates & Rankings | Nevada State Taxes | Tax ...

Taxes in Nevada. Each state’s tax code is a multifaceted system with many moving parts, and Nevada is no exception. The first step towards understanding Nevada’s tax code is knowing the basics. How does Nevada rank? Below, we have highlighted a number of tax rates, ranks, and measures detailing Nevada’s income tax, business tax, sales tax, and property tax systems.2018 Statewide Sales/Use Tax Rate Tables

01/2018 - 03/2018 - XLS: Statewide sales/use tax rates for the period beginning January, 2018: Business Tax. Tax Forms Frequently Asked Questions Electronic Filing Business Registration Tax Calendar Tax Clearance Tax Collection Tax Credits Tax Increment Financing (TIF) ...The nevada sales tax rate 2018 Washoe County, Nevada sales tax is 8.27%, consisting of 4.60% Nevada state sales tax and 3.67% Washoe County local sales taxes.The local sales tax consists of a 3.67% county sales tax.. The Washoe County Sales Tax is collected by the merchant on all qualifying sales made within Washoe County; Groceries are exempt from the Washoe County and Nevada state sales taxes

RECENT POSTS:

- lv handbags sale usa

- louis vuitton neverfull gm 2019

- pink patent leather purses

- christmas 2020 bank holidays uk

- mens wallet amazon india

- michael kors bags outlet uk

- cheapest louis vuitton jewelry box

- repurposed louis vuitton fringe purses texas

- hermes bag most expensive

- louis vuitton heat stamp made in usa

- louis vuitton tag codes

- best cheap rims reddit

- waterfront homes for sale in paris tenn

- michael kors selma handbag