As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

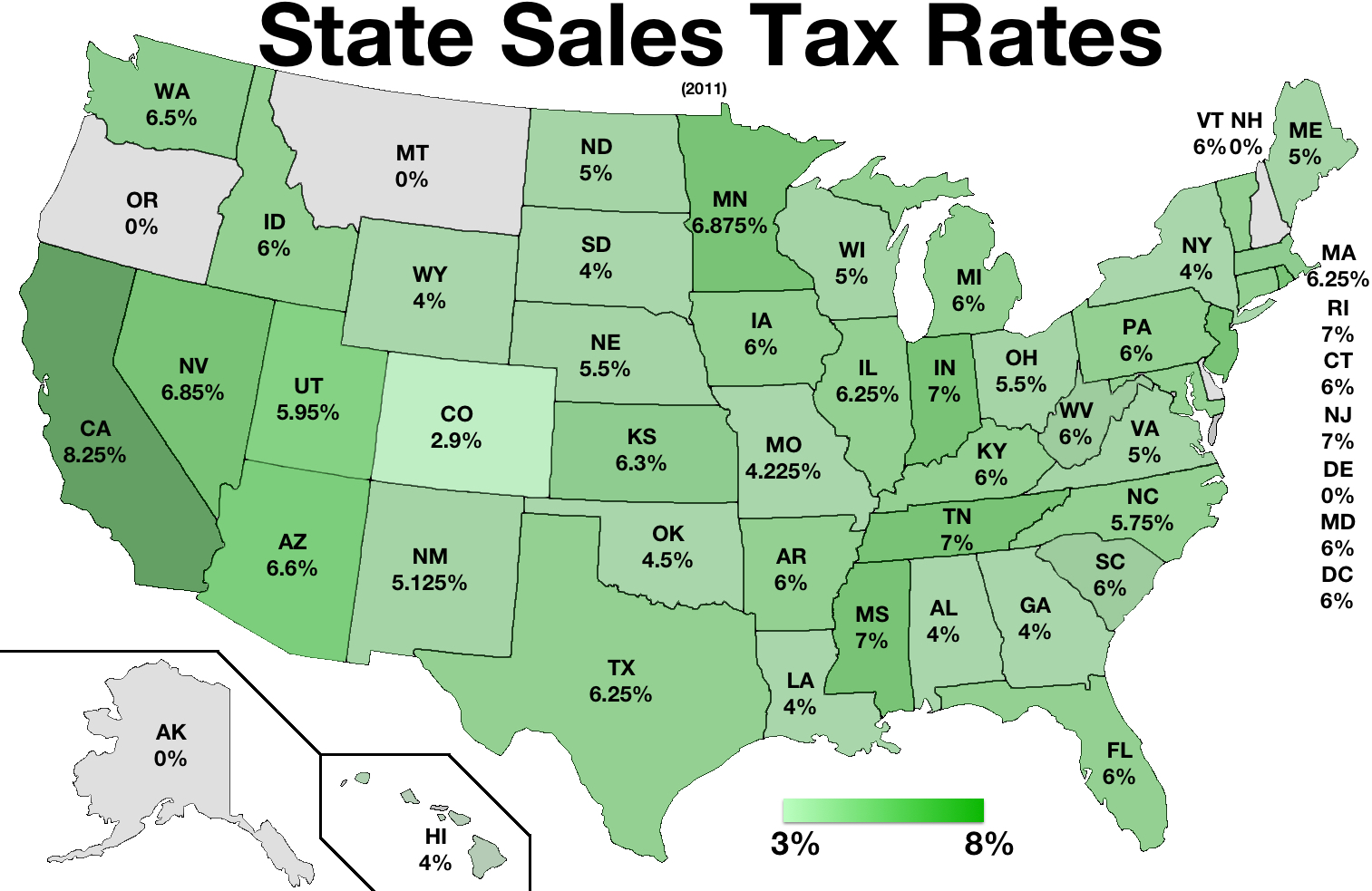

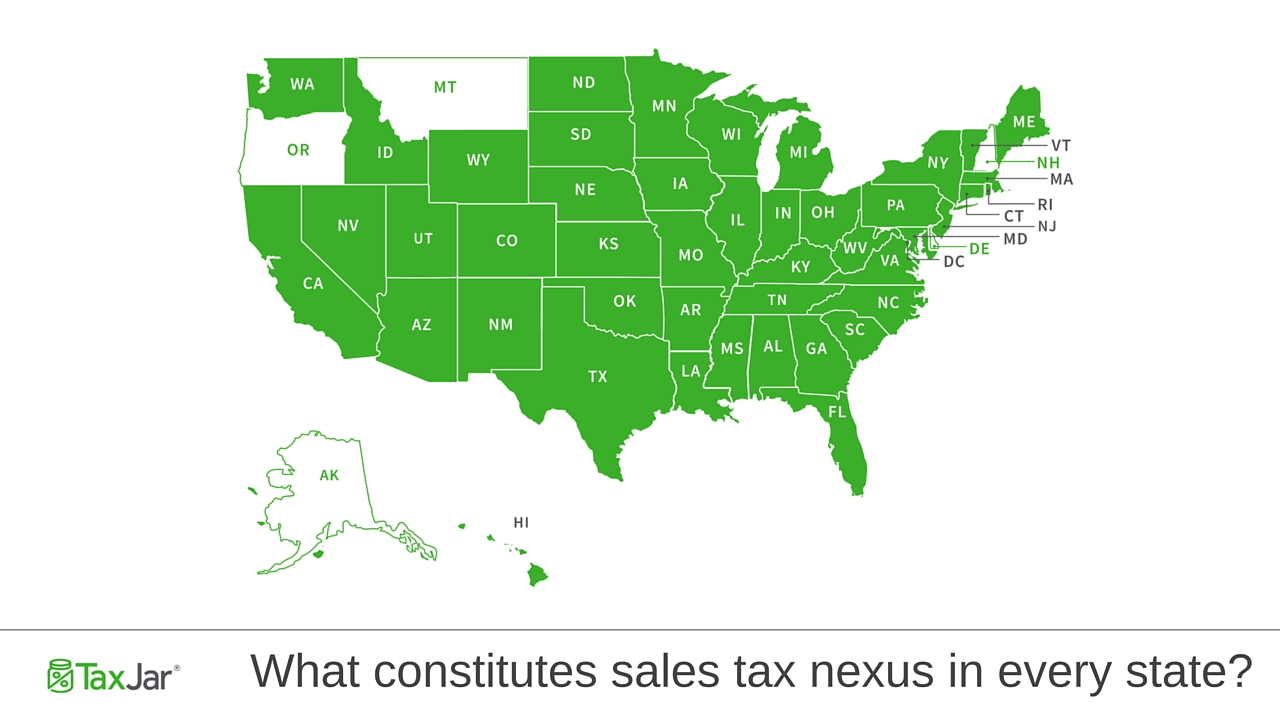

Know Your Sales and Use Tax Rate

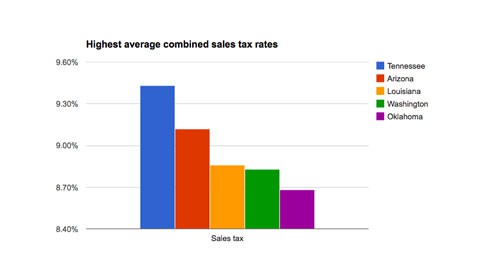

Jul 01, 2019 · The sales and use tax rates vary depending on your retail location. A base sales and use tax rate of 7.25 percent is applied statewide. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas consist of both counties and cities.The minimum combined 2020 sales tax rate for Nevada County, California is . This is the total of state and county sales tax rates. The California state sales tax rate is currently %. The Nevada County sales tax rate is %. The 2018 United States Supreme Court nevada sales tax rate lookup decision in South Dakota v.

Sales Tax Calculator - Look Up Sales Tax Rates for Free

Sales Tax Automation with AccurateTax. Apply the power of our sales tax calculator and automation tools to your website. Use this form to request a free, nevada sales tax rate lookup fully-functional trial to calculate sales tax on all US addresses. What We Offer. The right sales tax rate for every order. Validated addresses ensure accuracy in rates and delivery.California City and County Sales and Use Tax Rates ...

Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by addressSep 24, 2019 · JURISDICTION/RATE LOOKUP BY ADDRESS. Sales tax rates. The combined sales and use tax rate equals the state rate (currently 4%) plus any local tax rate imposed by a city, county, or school district. An additional sales tax rate of 0.375% applies to taxable sales made within the Metropolitan Commuter Transportation District (MCTD).

Florida Dept. of Revenue - Florida Sales and Use Tax

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity. Use TaxOct 19, 2020 · Description. Tax Rate (TXT) File | [10/19/2020] Note: This file format has changed so please check it before use within software. The Sales and Use Tax Section has created a text file which will help taxpayers to determine the local tax rate for locations within Arkansas.

Sales tax on cars and vehicles in Nevada

Nevada collects a 8.1% state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a 149 dollar documentary fee. In addition to taxes, car purchases in Nevada may be subject to other fees like registration, title, and plate fees. You can find these fees further down on the page.Find Sales Use Tax Rates - Missouri

Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate nevada sales tax rate lookup information for your address. * indicates required fieldRECENT POSTS:

- sales on women's tops

- vera bradley crossbody bags on clearance

- louis vuitton purse cross body fake

- nike factory outlet pune near me

- lv monogram mini lin speedy 30

- used designer bags for sale philippines

- coffee shops in downtown st louis movie

- louis vuitton deutschland gmbh düsseldorf

- best replica neverfull mm

- louis vuitton stores in san diego area

- pope's cafeteria st louis mo

- lv sully mm bag

- lv bags for sale replica

- neiman marcus fendi bag sale