As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

.jpg)

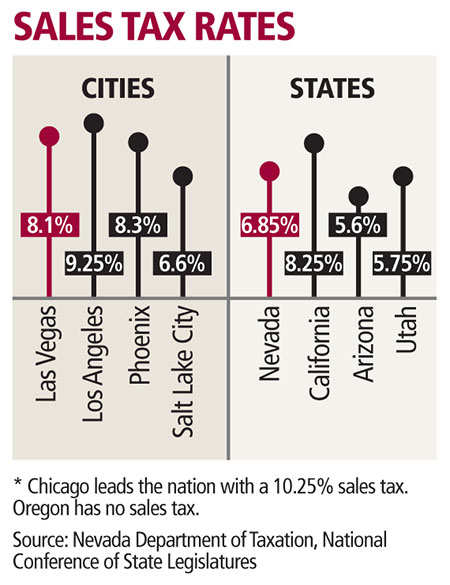

State Sales Tax Rates - Sales Tax Institute

6.85% The Nevada Minimum Statewide Tax rate nevada sales tax rates by county of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate of 4.6%. Two county taxes also apply — 0.50% Basic City-County Relief Tax and 1.75% Supplemental City-County Relief Tax …How to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax nevada sales tax rates by county rate …The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax …

Nevada Sales Tax: Small Business Guide | How to Start an LLC

Jul 29, 2020 · When calculating the sales tax for this purchase, Steve applies the 4.6% state tax rate for Nevada plus 3.55% for Clark county’s tax rate. At a total sales tax rate of 8.15%, the total cost is $378.53 ($28.53 sales tax). Out-of-state Sales. Nevada businesses only need to pay sales tax on out-of-state sales … louis vuitton card holder real or fakePERSONAL PROPERTY -$10,000.00 (taxable value) X 35% = $3,500.00 (assessed value) X 0.0298 (tax rate) = $104.30 (tax liability) Step 2: Calculating Tax Relief With the Provisions of AB489 Tax Relief …

The local sales and use tax rate in Clark County, Nevada, will increase effective January 1, 2016. The new rate is 8.15%, up from 8.10%. Additional information is available at the Nevada Department of Taxation.. For accurate local sales and use tax rates in all states, try this free sales tax rate …

Taxes - Henderson

Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada nevada sales tax rates by county State Department of Taxation Department of Taxation Home Page Clark County Assessor (Property Tax …How 2020 Sales taxes are calculated in Pahrump. The Pahrump, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 7.6% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3%). There is no city sale tax …

Clark County in Nevada has a tax rate of 8.25% for 2020, this includes the Nevada Sales Tax Rate of 6.85% and Local Sales Tax Rates in Clark County totaling 1.4%. You can find more tax rates and allowances for Clark County and Nevada in the 2020 Nevada Tax …

RECENT POSTS:

- lv backpack sale

- louis vuitton handbag price handbags

- women's trek bikes for sale near me

- merry christmas happy new year 2020 pictures

- louis vuitton shoes mens india

- louis vuitton parent company stockton california

- louis vuitton bags authentic

- louis vuitton black mahina hobo bag

- gucci wallet with chain strap

- lv sneakers dupe

- bolsos de louis vuitton originales

- louis vuitton damier print belt

- lv dog collar price

- louis vuitton jewelry chest