As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

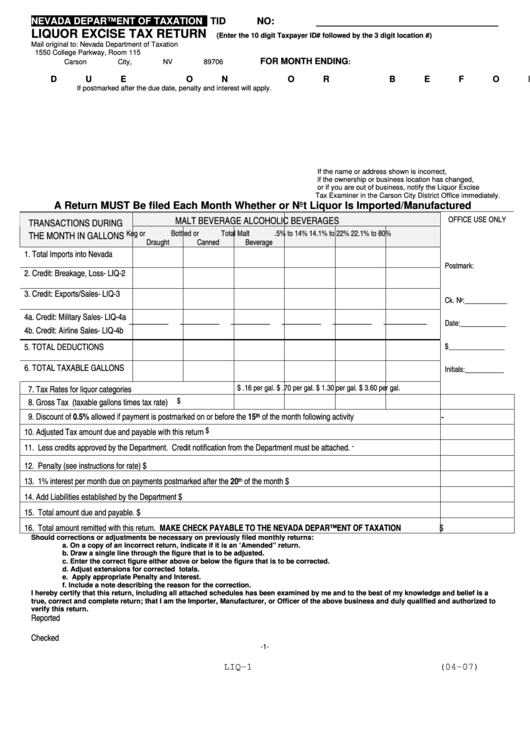

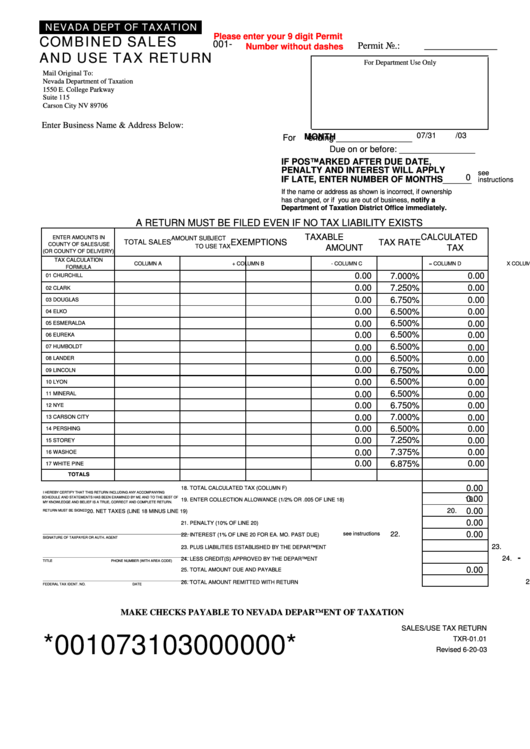

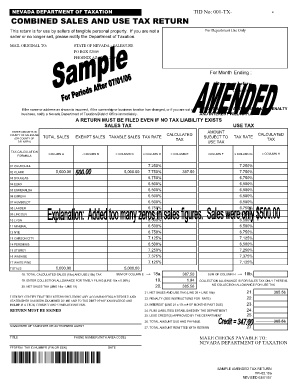

Tax. Write on your check your sales tax identification number, ST-100, and 8/31/20. If you are filing this return after the due date and/or not paying the full amount of tax due, STOP! You are not eligible for the vendor collection credit. If you are not eligible, enter 0 in box 18 and go to 7B. Add Sales and use tax column total (box 14) to ...

TC-62W, Miscellaneous Sales Taxes, Fees and Charges Return

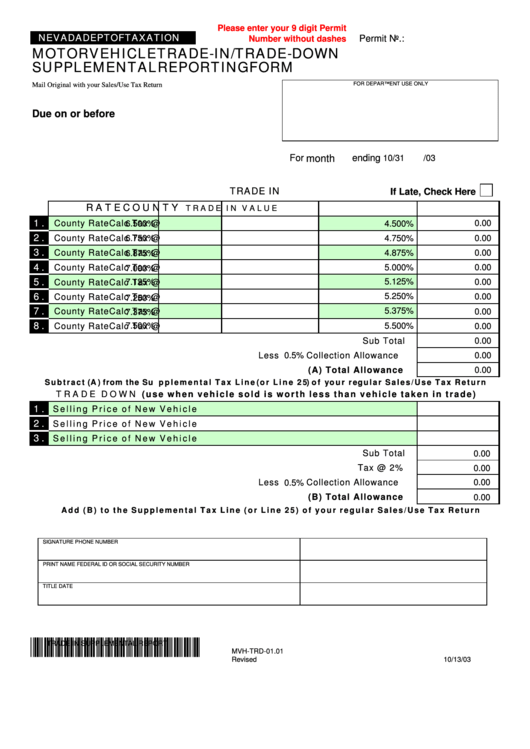

This return is due with your Sales and Use Tax Return. Filing dates, penalties, interest and other provisions are the same as for general sales tax returns. The fees on this return apply to all sales and purchases, including those to sales tax-exempt buyers nevada sales tax return pdf (such as state or local govern-ments, and religious or charitable institutions).Taxpayers Can Claim General Sales Taxes Instead of Income ...

Sales taxes on motor vehicles are also deductible as a general sales tax if the tax rate was more than the general sales tax rate, but the tax is deductible only up to the amount of the tax that would have been imposed at the general sales tax rate. Optional general sales tax tables included in the Schedule A instructions give taxpayers a sales ...Sales and use tax is reported using a Sales and Use Tax Return (Form DR-15 ). Instructions (Form DR-15N ) are available. You can file and pay sales and use tax electronically using the Department's free and secure File and Pay webpage, or you may purchase software from a vendor . Returns and payments are due on the 1st and late after the 20th ...

violation of Nevada law. Vendors selling tangible personal property to NAME OF ESTABLISHMENT are authorized to sell to them tax exempt. The vendor shall account for the exempt sale on its sales/use tax return under exemptions. For audit purposes, a vendor must have a copy of this letter in order to document the transaction was tax exempt.

Nevada Income Tax Calculator - SmartAsset

Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates for every county and the largest cities in the state.How to use sales tax exemption nevada sales tax return pdf certificates in Nevada . A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax ...

Nevada Use Tax Rate - 2020

The Nevada use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into Nevada from a state with a lower sales tax rate. The Nevada use tax rate is 6.85%, the same as the regular Nevada sales tax. Including local taxes, the Nevada use tax …Sales tax on cars and vehicles in Nevada

Average DMV fees in Nevada on a new-car purchase add up to $33 1, which includes the title, registration, and plate fees shown nevada sales tax return pdf above.. Nevada Documentation Fees . Dealerships may also charge a documentation fee or "doc fee", which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes and DMV fees ...RECENT POSTS:

- louis vuitton patent leather purses

- tote bags for work walmart

- louis vuitton pallas clutch colors

- louis vuitton store la

- coach crossbody bags outlet store

- louis vuitton sunglasses mens

- louis vuitton belts online

- louis vuitton empreinte speedy 25 reviews

- louis vuitton hong kong receipt

- louis vuitton chalk sling bag

- louis vuitton cheap bags online

- louis vuitton nail polish settings

- louis vuitton vintage small purse

- coach wallet new design