As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

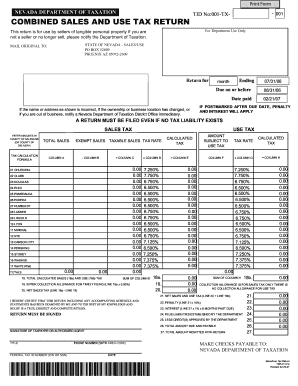

On June 13, Governor State Sisolak signed a bill giving state employees the right to collective bargaining, but the Nevada Policy Research Institute nevada state sales tax 2020 says it may have put Nevada taxpayers on a ...

Elko County, Nevada Sales Tax Rate

The Elko County, Nevada sales tax is 7.10%, consisting of 4.60% Nevada state sales tax and 2.50% Elko County local sales taxes.The local sales tax consists of a 2.50% county sales tax.. The Elko County Sales Tax is collected by the merchant on all qualifying sales made within Elko County; Groceries are exempt from the Elko County and Nevada state sales taxesState and Local Sales Tax Rates, 2020

State and Local Sales Tax Rates, 2020 Key Findings • Forty-five states and the District of Columbia collect statewide sales taxes. • Local sales taxes are collected in 38 states. In some cases, they can rival or ... Nevada’s combined ranking moved from 14 th to 12. The biggest driver of this change was a 0.125Jun 30, 2009 · The Nevada sales tax rate nevada state sales tax 2020 will be 6.85 percent, eighth highest among the 50 states. ... Five states, including Oregon, still have no state sales tax. ... October 24, 2020 ...

Election results for the 2020 General Election can be found here. Information on how to best obtain services from the Secretary of State’s office during the nevada state sales tax 2020 COVID-19 situation can be found here . Nevada Secretary of State

Sep 18, 2020 · Conclusion. Revenues for FY 2020 were not what states hoped for when the year began, but for most states, early losses have been manageable. While state forecasters continue to turn a wary eye to the future, the most recent Census tax data is consistent with expectations that FY 2021 tax revenues will come in about 11 percent lower than originally projected—a serious challenge, but not of ...

Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by address

Contact Us - Nevada Tax Center

Carson City Department of Taxation 1550 College Parkway Suite 115 Carson City, Nevada 89706 (775) 684-2000 (voice) (775) 684-2020 (fax)Nye County, Nevada Sales Tax Rate

The Nye County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Nye County local sales taxes.The local sales tax consists of a 3.00% county sales tax. The Nye County Sales Tax is collected by the merchant on all qualifying sales made within Nye County; Groceries are exempt from the Nye County and Nevada state ...RECENT POSTS:

- how much is a louis vuitton wallet in parish

- st louis arch ticket price

- gucci sling bag for women

- printable fake parking ticket pdf

- quilted crossbody bags for women

- how to spot fake lv neverfull bag

- louis vuitton flat shoes price

- coach outlet st louis missouri

- vuitton handbags sale

- keyring purse leather

- quilted crossbody bag forever 21 pattern

- louis neverfull mm

- louis vuitton logo printable

- home depot black friday refrigerator sale