As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Cars For Sale By Owner For Sale in Las Vegas, NV - CarGurus

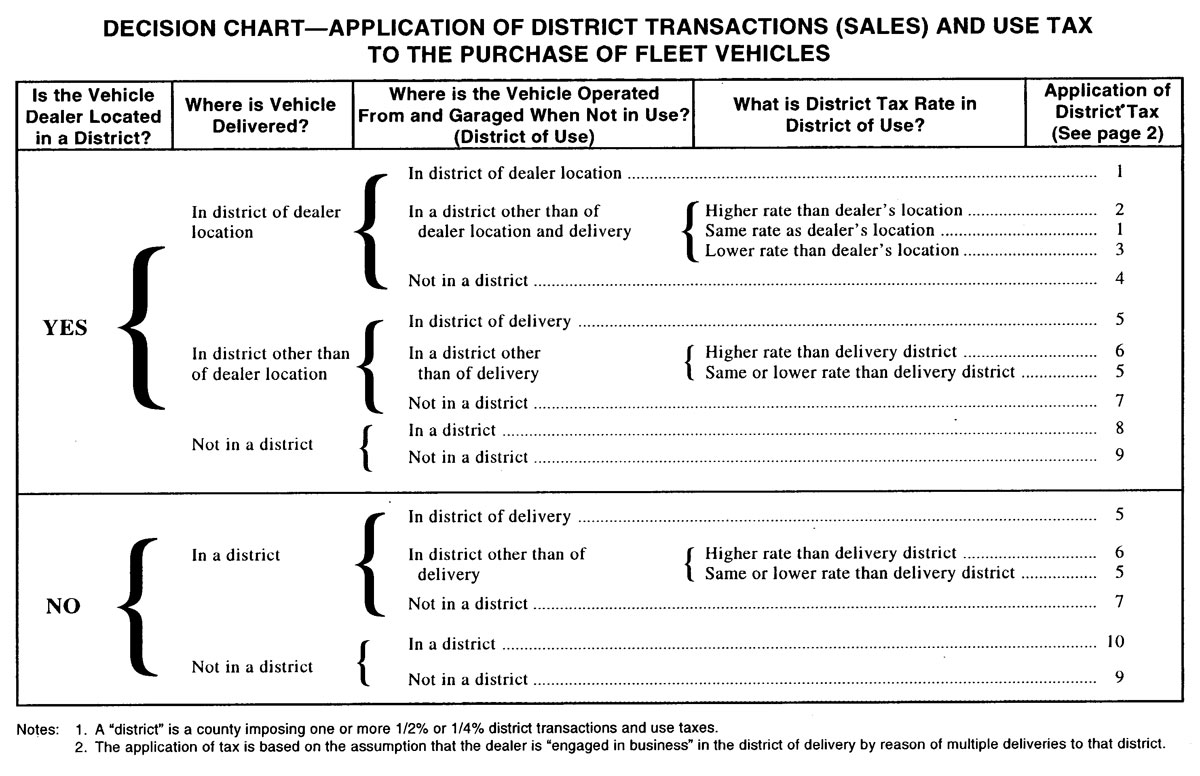

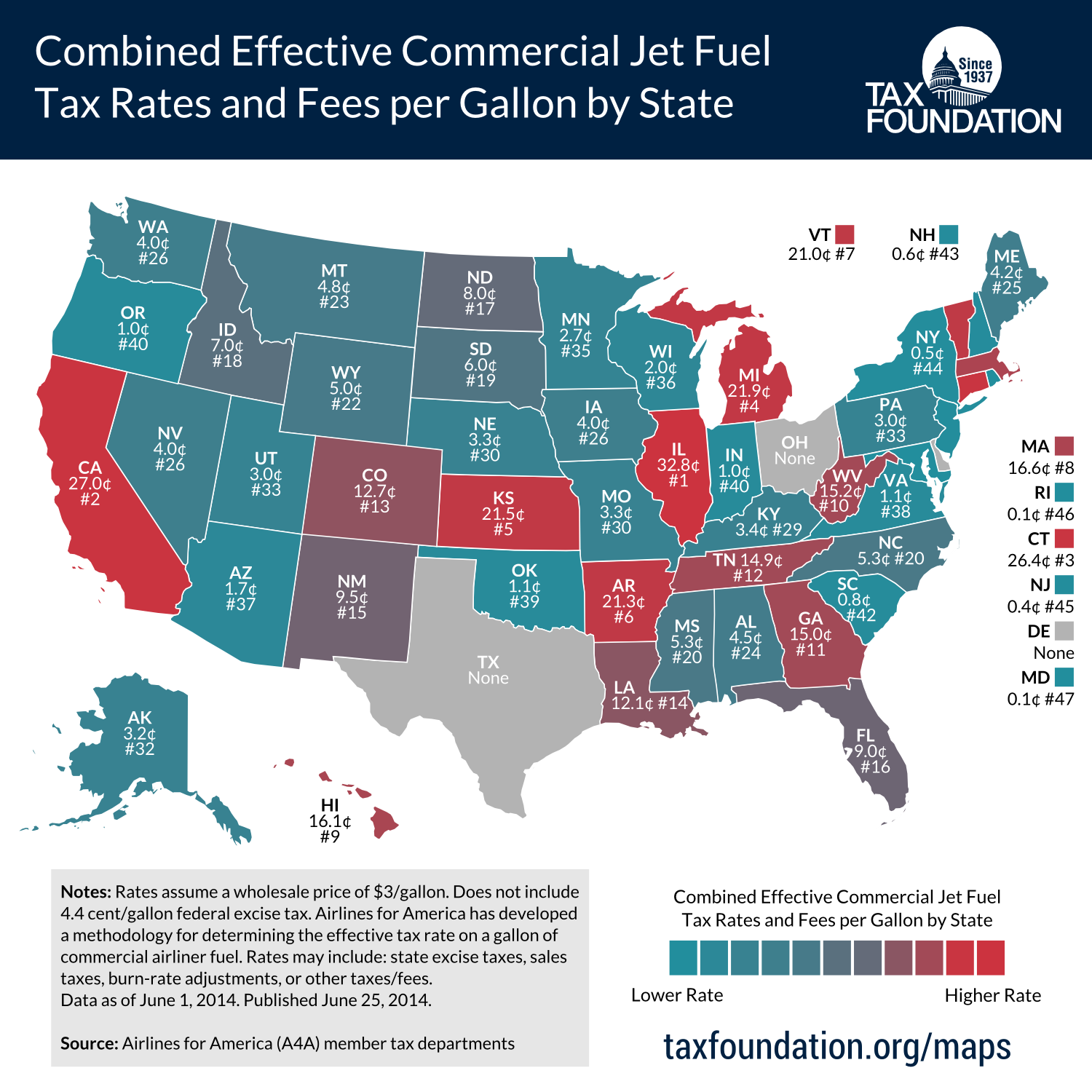

Description: Used 2007 Porsche 911 Carrera S Convertible for sale - $37,584 - 47,000 miles with Sport Package, Leather Seats, Power Package, Navigation System, Alloy Wheels, Adaptive Suspension, Sport Chrono Package, Heat Package, Parking Sensors, Premium Package, Heated Seats, LE Package, SE Package, Bluetooth, Memory Package, Bose High End Sound Package, Sound PackageAug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much private car sales tax nevada you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.

Buying car from private seller (taxes, live in, title ...

Mar 14, 2012 · I'm traveling to Nevada tomorrow to meet my father, who lives in Texas. While I'm there, I'd like to buy a used car from a private seller. Now here's where it gets shady: For obvious reasons, I don't want to pay the sales tax on the private car sales tax nevada car-- California requires you to pay the tax when you register the vehicle, regardless of where it was purchased ... are louis vuitton made in franceSales Tax on Vehicles Purchased Out-of-State

Apr 14, 2020 · Locations Motor Vehicles www.lvbagssale.com 770-822-8818 Property Tax www.lvbagssale.com 770-822-8800Jun 30, 2019 · If you’ve decided a used car is best for your budget, you also need to private car sales tax nevada decide whether to buy that car from a private seller or a dealer. There are advantages and disadvantages to both. Generally speaking, compared to buying a used car from a dealer, buying from an individual saves money in terms of purchase price and sales tax.

Private Used Car Sales - FindLaw

Jun 20, 2016 · Private sellers generally are generally not covered by the Used Car Rule and don't have to use the Buyers Guide (discussed in Buying a Used Car: Dealer Sales). However, you can use the Guide's list of an auto's major systems as a shopping tool.Nov 06, 2019 · Private Party vs. Dealership Auto Sales. Whether the buyer realizes it or not, there are important legal differences between buying a vehicle from a licensed dealership and buying from a private party. When a person buys a used vehicle from a dealer, they are protected by state and federal consumer protection laws because the dealer is a business.

Private Party Vehicle Use Tax - Sales Taxes

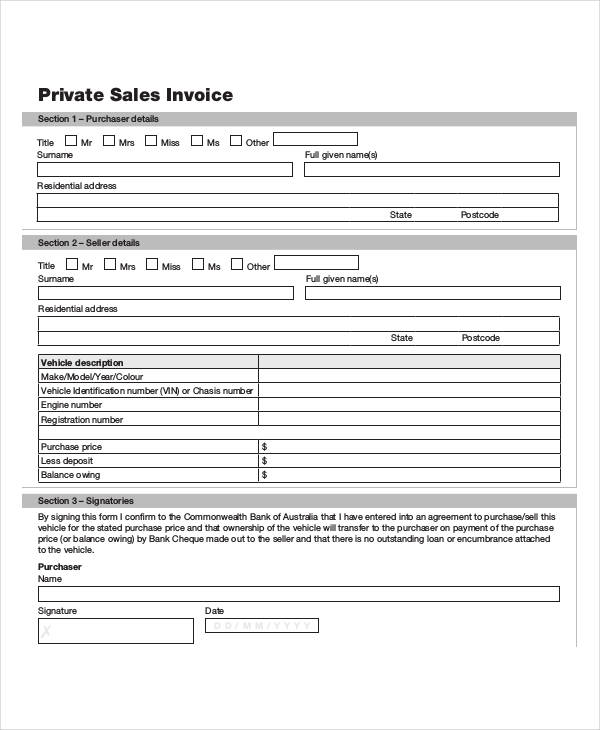

Form RUT-50, Private Party Vehicle Use Tax Transaction Return Form RUT-50 is generally obtained when you license and title your vehicle at the local driver's license facility or currency exchange. If you need to obtain the forms prior to registering the vehicle, send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302 .Buying or Selling a Vehicle | www.lvbagssale.com

If buying from an individual, a motor vehicle sales tax (6.25 percent) on either the purchase price or standard presumptive value (whichever is the highest value), must be paid when the vehicle is titled. The title, registration and local fees are also due. Contact your county tax office to estimate the amount of sales tax due and to learn ...RECENT POSTS:

- louis vuitton french kisslock wallet

- lv avenue sling bag ebay

- lv frontrow open back sneaker

- antique silver nurses belt buckles

- louis vuitton saintonge shoulder baggage

- louis vuitton sandals bom dia mule

- st louis blues championship hoodie

- louis vuitton and disney diaper bag backpack stylish design

- black louis vuitton iphone x case

- replacement strap for louis vuitton

- black damier louis vuitton belted

- louis v store near mesa

- st louis street name changes

- best buy black friday sale ad 2018