As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

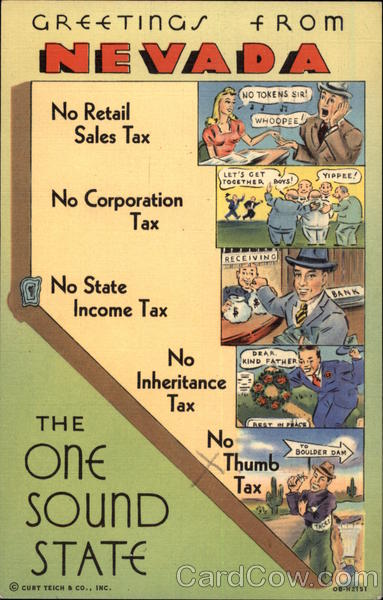

A Reno, Nevada Sales Tax Permit can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a Reno, Nevada Sales Tax Permit.

Tax Jobs, Employment in Reno, NV | 0

243 Tax jobs available in reno nevada sales tax Reno, NV on 0 Apply to Tax Intern, Risk Analyst, Administrative Assistant and more!Sales Taxes. An out-of-state dealer may or may not collect sales tax. See the Nevada Department of Taxation Sales and Use Tax Publications reno nevada sales tax for current tax rates. Rates vary by county. Many dealers remit sales tax payments with the title paperwork sent to the DMV Central Services Division.

If sales tax is due, proof that sales tax was paid by an Off-Highway Vehicle Report of Sale from a Nevada dealer or a Use Tax Clearance Certificate (Form APP-08.01) from the Department of Taxation. If sales tax is not due (as in a private party sale), the affidavit available in Form OHV-001C must be completed.

Find and bid on Residential Real Estate in Washoe County, NV. Search our database of Washoe County Property Auctions for free!

Step by Step Guide to Business Licensing

The tax is paid to the Nevada State Department reno nevada sales tax of Taxation. The tax is .5% of the first $62,500 of wages paid during a calendar quarter, increasing to 1.17% of total wages paid exceeding that amount. NV State Department of Taxation - Las VegasNevada Sales Tax Rate & Rates Calculator - Avalara

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.Official Nevada Department of Motor Vehicles Website ...

The Nevada Department of Motor Vehicles issues drivers licenses, vehicle registrations and license plates in the Silver State. It also licenses, regulates and taxes the …Mar 28, 2019 · The sales tax in Reno, NV, for example, is 8.26 percent. Las Vegas sales tax is 8.25 percent. Carson City, Fallon and Cold Springs all charge a 7.6 percent sales tax, which is significantly lower. If your company operates in several states, you must register for and collect sales tax …

RECENT POSTS:

- louis vuitton outlet italy online

- louis vuitton neiman marcus garden city

- louis vuitton neverfull damier clutch

- mercy hospital st louis women's health

- louis vuitton little girl shoes

- leather wallets wholesale manufacturer

- small leather makeup bag for purse

- mark louis photography facebook page

- oracion san luis beltran para los ninos

- lv jeanne wallet

- men's warehouse suit sale

- livermore bloomingdale's outlet

- original louis vuitton printable

- nano belt bag review