As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

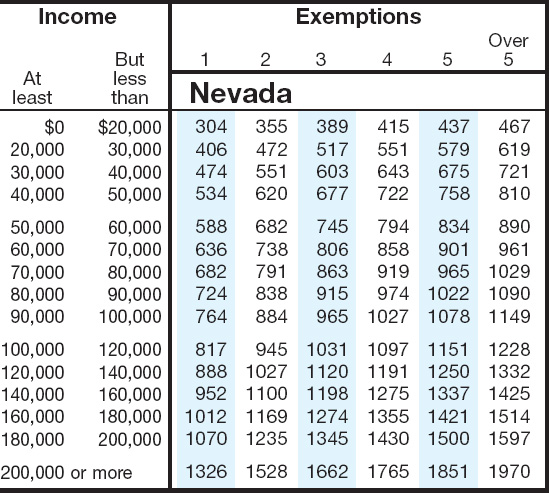

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Do You Pay Sales Taxes on a New Car Minus the Trade In ...

Jan 29, 2019 · For example, while New Hampshire has no state sales tax, the fees you pay to your local town are likely even higher than the taxes assessed by most other states. Nevada charges a state sales tax of 6.5 percent, a government services tax of 1.4 percent, and a gas-guzzler tax on cars …Average DMV fees in California on a new-car purchase add up to $244 1, which includes the title, registration, and plate fees shown above.. California Documentation Fees . Dealerships may also charge a documentation fee or "doc fee", which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes …

2020 Arizona Car Sales Tax Calculator | Valley Chevy

Aug 12, 2020 · This will give you the sales tax you should expect to pay. For example, if your budget for your next car is $15,000, and you make your purchase in Apache County, you would pay about $915 in sales tax (15,000 x .061). Tax on New Cars vs. Used CarsSales tax calculator for Nevada, United States in 2020

How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada …Private Sales. For cars bought in a private sale, you must receive certain documents from the seller in order to properly transfer ownership at your local DMV. These include: A signed and completed vehicle title*, including: . The odometer disclosure statement, if the vehicle is under 10 years old.; The sale date.; The purchase price.; A Nevada Emission Vehicle …

Private party sales: Do I need to pay taxes on person-to ...

Apr 11, 2018 · Tax obligation with you buy a car through a private sale When sales tax nevada car you purchase a vehicle through a private sale you must pay the associated local and state taxes. In most states, you’ll need to bring your Bill of Sale and or signed title to the Department of Motor Vehicles (DMV) or motor vehicle registry agency to pay your taxes …I am a California resident, if I buy a new car in Nevada ...

Mar 21, 2015 · We are selling the company for 2.5 million dollars and I am a partner. I get 50% of the sale, so I get 1.25m when the sale goes through. I do not own any equity in the company. My question is I am planning to move back to Nevada this year to avoid the state income tax before the sale …Vehicle Sales Tax Deduction | H&R Block

To deduct vehicle sales tax, you can either: Save all sales receipts and deduct actual sales taxes paid throughout the year, or; Use the IRS sales tax tables to figure your deduction. These tables calculate the estimated sales tax …Tax-Friendly Places to Buy a Car | Kiplinger

Jan 05, 2012 · The most expensive state to own a typical car, in terms of taxes and fees, is Nevada, where you'll pay $2,507 over five years for a Toyota Camry LE. With a sales tax of 6.5%, its one-year …RECENT POSTS:

- louis vuitton keepall blue strapless

- daily organizer wallet louis vuitton

- louis vuitton holdall mens uk

- black friday tv 80 inch

- louis vuitton travel wallet

- boxing speed bag drills youtube

- louis vuitton handbags at macys

- alicia vikander by louis vuitton

- vintage fendi zucca crossbody bag

- first copy louis vuitton bags indiana

- mens ferragamo belt buckle

- lv multi pochette accessoires real vs fake

- gucci bag for sale nz

- coach crossbody bag sale usa only