As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

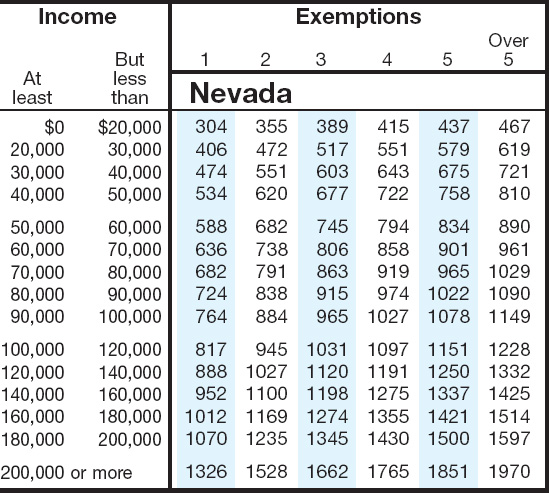

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Vehicle Sales Tax Deduction | H&R Block

To deduct vehicle sales tax, you can either: Save all sales receipts and deduct actual sales taxes paid throughout the year, or; Use the IRS sales tax tables to figure your deduction. These tables calculate the estimated sales tax you paid based on your income. They don’t include large purchases. So, to the amount in the table, you can add ...Apr 11, 2018 · Tax obligation with you buy a car through a private sale When you purchase a vehicle through a private sale you must pay the associated local and state taxes. In most states, you’ll need to bring your Bill of Sale and or signed title to the Department of Motor Vehicles (DMV) or motor vehicle registry agency to pay your taxes sales tax nevada cars and obtain your ...

2020 Arizona Car Sales Tax Calculator | Valley Chevy

Aug 12, 2020 · If you have any other questions about Arizona vehicle sales tax, reach out today and get the answers you need. Posted on Posted on August 12, 2020 September 1, 2020 by Joe Pelosi. Joe has been closely associated with the automotive industry for the past 10 years. He worked closely with dealerships at his previous job with the Charlotte Observer ...2. Sales Tax Rates. Forty-five states and the District of Columbia collect sales tax. In addition, municipalities in 38 states impose a local sales tax. In some cases, the local sales tax rate can be higher than the state sales tax rate. So when you’re comparing sales tax rates from state to state, look at both the combined state and local ...

If you spend $7,000 on a car and an additional $1,000 on improvements but you sell the car for $7,000, it’s considered a capital loss, and you don’t need to pay tax on the sale. But if the original purchase price plus the improvements add up to $8,000 and you sell the car for $10,000, you’ll have to pay capital gains tax on your $2,000 ...

State Sales Tax Rates - Sales Tax Institute

6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes sales tax nevada cars combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate of 4.6%. Two county taxes also apply — 0.50% Basic City-County Relief Tax and 1.75% Supplemental City-County Relief Tax equals an additional city ...According to Sales Tax States, 61 of Utah's 255 cities, or 23.922 percent, charge a city sales tax. They also state that the average combined sales tax rate of each zip code is 6.775 percent.

Sales tax calculator for Las Vegas, Nevada, United States ...

How 2020 Sales taxes are calculated in Las Vegas. The Las Vegas, Nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of Las Vegas may vary from 8.25% to 8.375% Every 2020 combined rates mentioned sales tax nevada cars above are the results of Nevada state rate (4.6%), the county rate (3.65% to 3.775%). There is no city sale tax for ...Tax-Friendly Places to Buy a Car | Kiplinger

Jan 05, 2012 · Nevada's charge includes a "government services tax" of 1.4% of the depreciated value of the vehicle, which boosts the total taxes and fees for the Camry to $275 in year two, $247 in year three ...RECENT POSTS:

- cheap tumi luggage sale

- louis vuitton shoulder crossbody

- louis vuitton cruise campaign 2019-20-

- louis vuitton ombre nomade sample

- average rent in st louis mo

- how to tell if your louis vuitton bag is real or fake

- lv favorite mm dupe

- louis vuitton london travel bookstore

- louis vuitton chain wallets

- louis vuitton wedding dress dresses

- best cross body purses for travel

- lv bucket hat etsy

- neverfull mm bag liner

- louis vuitton shop online store usa