As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

The Pilot's Guide to Taxes - AOPA

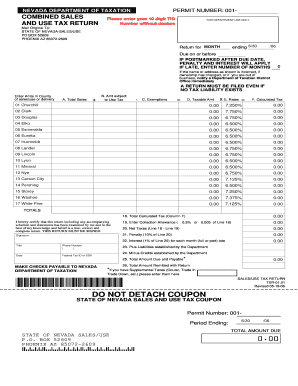

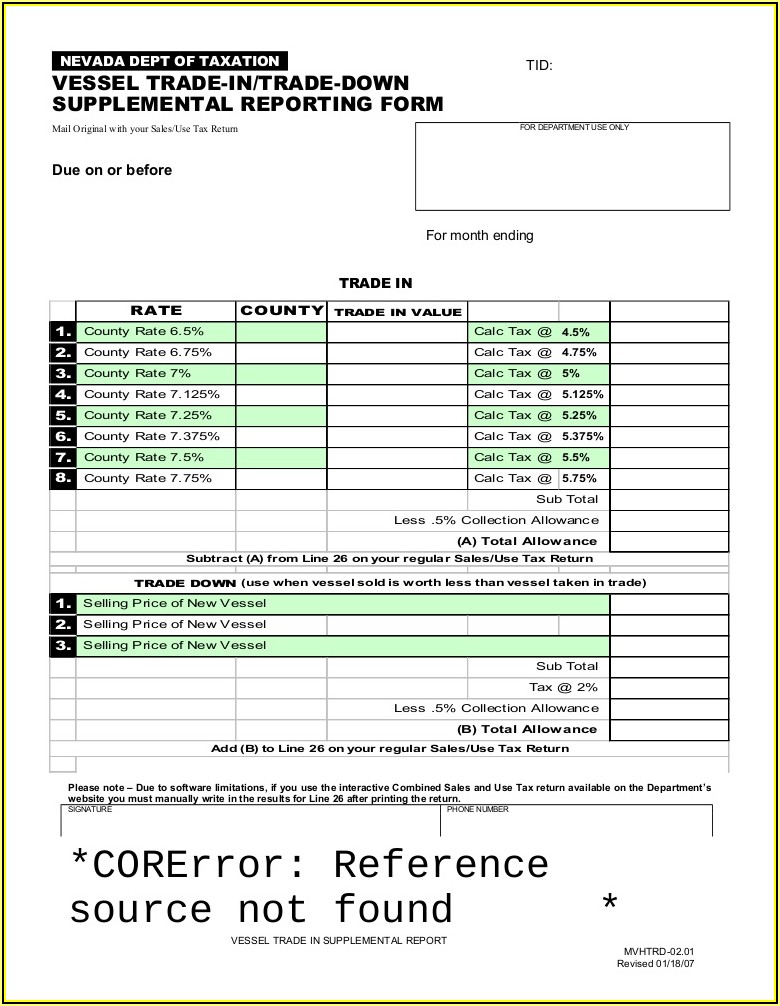

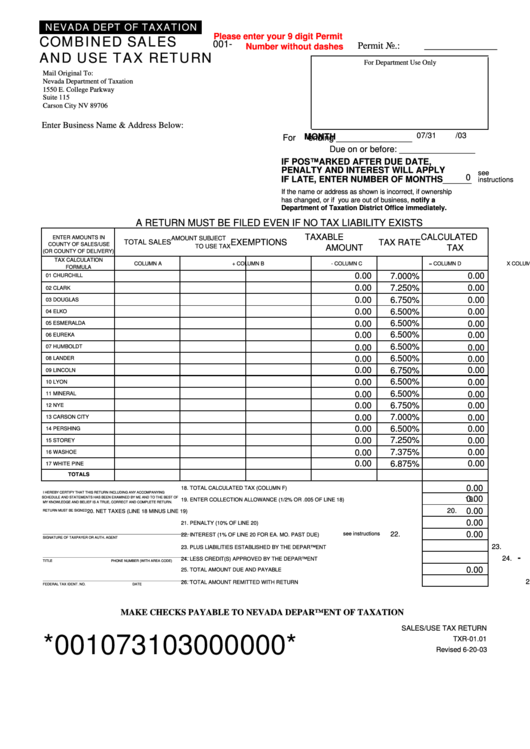

The classic definition of a sales tax is a tax imposed on the sale of tangible personal property within a state. Most of us are quite familiar with the concept of a sales tax. We pay sales taxes on our smallest purchases up to our big-ticket items like cars, boats - and yes, aircraft.Jan 08, 2020 · If sales tax nevada form you live in NEVADA ... and you are filing a Form ... and you ARE NOT ENCLOSING A PAYMENT, then use this address ... and you ARE ENCLOSING A PAYMENT, then use this address ...; 1040. Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002

Nevada Sales Tax Application Registration Any business that sells goods or taxable services within the state of Nevada to customers located in Nevada is required to collect sales tax from that buyer. This will include all online businesses.

Get details on the Nevada sales tax online here. Nevada Sales Tax Rates. Sales tax rates do vary between states, counties and cities. Typically, the state will set a base sales tax rate, then specific counties and cities may levy small additional sales tax nevada form sales tax amounts on top of that. Federal Taxes for Your Nevada LLC: Self-Employment and Income Taxes

Jul 17, 2017 · Last updated July 17, 2017 For more information about collecting and remitting sales tax in Nevada, check out Nevada Sales Tax Resources. 1. Who needs a sales tax permit in Nevada? From the Nevada Department of Taxation website: Every person, firm,

How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate (0% to 0.25%).

Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of sales tax nevada form $10,000 ($5,000 if …

Nevada Tax Forms 2019 : Printable State Income Tax Forms ...

Jan 27, 2020 · Nevada Tax Forms 2019. Printable State Income Tax Forms and Instructions. Nevada is one of seven states which do not levy a personal income tax. Nevada state and local governments generate revenue primarily from sales tax and property tax. Residents of Nevada must still file federal Form 1040 or Form 1040SR each year.Nevada Internet Sales Tax | Nolo

New Rules on Collecting Sales Tax for Remote Sellers. Effective October 1, 2018, remote sellers whose sales in Nevada exceed certain thresholds must collect sales tax. Remote sellers are any sellers, including online retailers, who don’t have a physical presence in Nevada and are not otherwise required to register or collect sales tax in Nevada.RECENT POSTS:

- lv auto sales

- louis vuitton kanye west don

- mens wallet card holder

- louis vuitton black platform boots

- lv tuileries besace price

- gold chain clutch bag

- gucci purses nordstrom rack

- louis vuitton bags damier azur

- louis vuitton keepall prism price

- louis vuitton avenue sling bag real vs fake

- louis vuitton keepall 50 no strap

- louis vuitton in orlando fl

- louis vuitton mink fur hoodie price

- sale louis vuitton scarf