As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

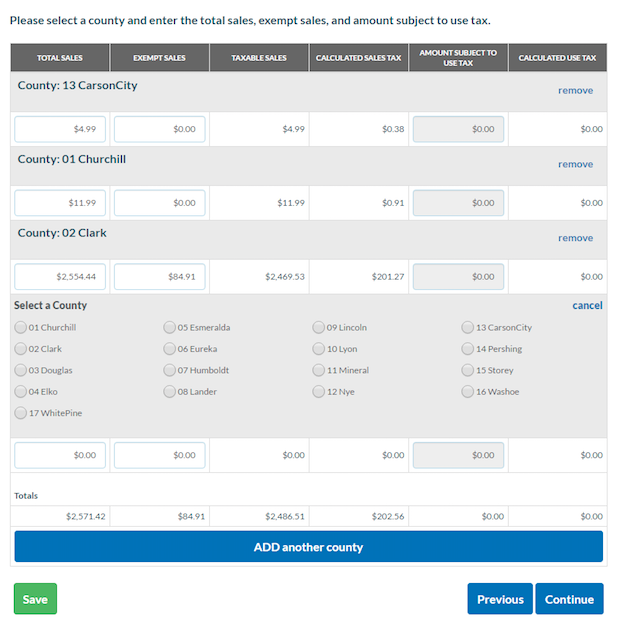

Jul 17, 2017 · Last updated July 17, 2017 For more information about collecting and remitting sales tax in Nevada, check out Nevada Sales Tax Resources. 1. Who needs a sales tax permit in Nevada? From the Nevada Department of Taxation website: Every person, firm,

How to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is 7.5 percent, you would multiply 5000 by .075.Nevada State Sales Tax Number. sales tax nevada General Information on State Sales Tax. Virtually every type of business must obtain a State Sales Tax Number. If your business sells products on the internet, such as eBay, or through a storefront, and the item is shipped within the same state, sales tax must be collected from the buyer and the sales tax must be ...

Nevada Sales Tax Audit Assistance – Introduction and Overview. Up is down; down is up. He says “Hello” when he leaves; “Goodbye” when he arrives. – Jerry Seinfeld. Anyone that’s been through a sales tax audit can relate to the backward and bizarre world that is a state and local tax. Getting the notice that you have been selected by Nevada to go through the long, grueling, and ...

Buying gold and silver in Nevada | 0

This tax applies when you make a profit from the sale of precious metals and it means that if you buy for $1,000 and sell for $2,000, you pay a tax of $280, leaving a profit of $720. Tax Free Precious Metals. Nevada’s tax laws are not straightforward, as some coins are taxed and others are not.Jan 08, 2018 · In Nevada, you can expect to pay an 8.25% sales tax rate on the purchase of all vehicles. In comparison to other states, that is a good tax rate, so you can rest assured that you are in a good position as a Nevada car buyer.

Does Nevada Have a Sales Tax? | Bizfluent

Mar 28, 2019 · The Nevada sales tax has been around since the 1950s. In 1955, it was established at 2 percent. In 2013, it reached 8.1 percent. Currently, it ranges between 6.68 percent and 8.26 percent.In 2018, Internet-based retailers and other remote sellers became subject to this tax, too. Those who exceed $100,000 in sales or sales tax nevada 200 transactions in the previous or current year are required to collect sales ...Nevada Tax Laws - FindLaw

While Nevada does not levy a personal income tax, the state makes up for it with some of the highest retail sales tax rates in the nation. Nevada also does not collect taxes on estates. Included in this section is an article detailing the retail sales tax rate, in addition to excise taxes on …Sales Tax Consulting Services in Nevada. Often times having a Nevada attorney or a tax law firm may be more expensive than necessary. Instead of spending tens of thousands on sales tax representation, we have former auditors to handle sales tax audits, and seasoned sales sales tax nevada tax consultants to handle your company’s sales tax appeals or protests. And, if need be, we have attorneys at our disposal ...

RECENT POSTS:

- st louis cardinals printable schedule 2020

- louis vuitton palm springs backpack mini price in paris

- shoulder sling bags

- lv artsy snake handle bags

- st louis yearly snowfall

- cycling musette bag uk

- louis the child red rocks presale

- louis vuitton jogging suit

- fake look alike louis vuitton handbags

- louis vuitton fringe bag

- louis vuitton mini pochette stock

- best rolling duffel bag reviews

- louis storey obit wahoo ne

- red louis vuitton supreme durag