As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

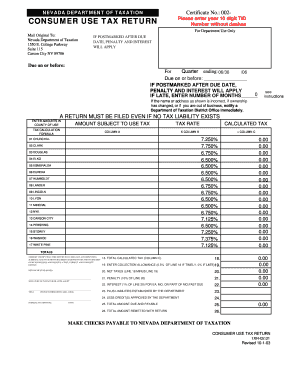

The minimum combined 2020 sales tax rate for Carson, California is . This is the total of state, county and city sales tax rates. The California sales tax rate is currently %. The County sales tax rate is %. The Carson sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

The www.bagssaleusa.com Nevada Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Nevada. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Nevada, local counties, cities, and special taxation districts.

Carson City, NV Sales Tax - Carson City Nevada Sales Tax ...

Carson City, NV Sales Tax Sales tax in Carson City Nevada is 7.6%.* *Average Nevada sales tax is 7.72.This number should be used to address questions regarding sales & use tax, modified business tax, general tax questions, or information regarding establishing a new account. (866) sales tax rate for carson city nevada 962-3707 Carson City Department of Taxation 1550 College Parkway Suite 115 Carson City, Nevada 89706 (775) 684-2000 (voice) (775) 684-2020 (fax) Reno Department of ...

May 13, 2014 · The Nevada Department of Taxation has announced that the sales and use tax rate for Carson City will increase from 7.475% to 7.60%, effective October 1, 2014.. This rate increase was approved by the Carson City Board of Supervisors.

The tax imposed on room rental is Lodging Tax. In Nevada, transient lodging tax and exemptions are set at the city/county level and varies by county. Any specific questions regarding exemptions and rates should be addressed to the city/county where the hotel is located. alma louis vuitton epi

The minimum combined 2020 sales tax rate for Reno, Nevada is . This is the total of state, county and city sales tax rates. sales tax rate for carson city nevada The Nevada sales tax rate is currently %. The County sales tax rate is %. The Reno sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

County Profile Report - Carson City, NV

Card. All numbers are 2016 unless noted otherwise, *2016-2017 tax rate, **2015, ^June 2017, ***2016-2017 school year. TAXES. Nevada . DOES NOT. have any of the following taxes: Personal State Income Tax • Unitary Tax • Corporate Income Tax Inventory Tax • Estate and/or Gift Tax • Franchise Tax. Inheritance Tax • Special Intangible Tax ...Nevada Property Tax: Elements and Applications Property Tax Rates for Nevada Local Governments (Redbook) NRS 361.0445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those sales tax rate for carson city nevada taxes.

RECENT POSTS:

- how big is louis vuitton keepall 500

- virgil abloh lv backpack

- lv chain bag price

- louis vuitton trainers ebay uk

- ebay gucci wallets for women

- louis vuitton in new jersey

- louis vuitton millionaire sunglasses 1.1 green

- leather trimmed canvas tote bags

- louis vuitton zipper fix

- louis vuitton male model salary

- goyard saint louis tote bag

- ski shop st louis

- louis vuitton large agenda for sale

- louis vuitton city center