As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

![sales tax rate in clark county nevada 2018 Las Vegas Sales Tax Rate 2020/2021 [Nevada] - TownPlasa](https://townplasa.com/wp-content/uploads/2020/05/6869765923_307afdd67c_tax-300x300.jpg)

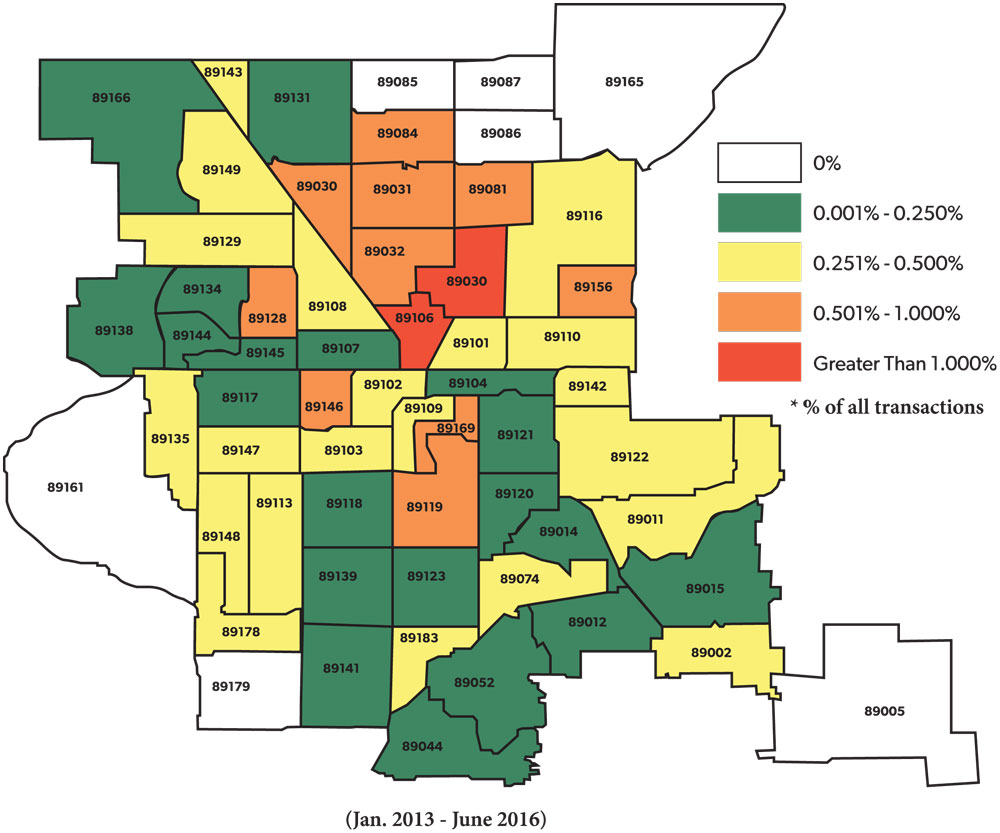

Nov 12, 2018 · Properties in Nevada County that have had tax delinquencies for five or more years may be offered for sale by the Tax Collector. The primary purpose of sales tax rate in clark county nevada 2018 the tax sale is to return the tax defaulted property to the tax rolls. Offering the property for sale achieves this by either selling the property or forcing redemption.

Tax Rates & Changes

There were no sales and use tax county rate changes effective July 1, 2018; 2nd Quarter (effective April 1, 2018 - June 30, 2018): There were no sales and use tax county rate changes effective April 1, 2018; 1st Quarter (effective January 1, 2018 - March 31, 2018): Rates listed by county and transit authority; Rates listed by city or village ...Fees and Taxes | Clark County

Taxes. Tax is due on all new or used purchases in Washington. Sales tax is due on all retail purchases, and use tax is due on all private party sales. Both taxes are calculated at the same rate. For private party sales, the purchase price of the vehicle must be within Department of Revenue determination of Fair Market Value. Fair Market Value ...Tax Lien Sales in Nevada | The Stone Law Firm

Upon payment of all taxes and costs, the county will reconvey the real property back to the owner. The Tax Lien Sale. In most counties in Nevada, tax lien sales are handled like auctions. This article covers the basics as well as specifics for Washoe and Clark Counties. The remaining counties in Nevada will be covered in a separate article.The Clark County, Washington sales tax is 7.70%, consisting of 6.50% Washington state sales tax and 1.20% Clark County local sales taxes.The local sales tax consists of a 1.20% county sales tax.. The Clark County Sales Tax is collected by the merchant on all qualifying sales made within Clark County; Groceries are exempt from the Clark County and Washington sales tax rate in clark county nevada 2018 state sales taxes

Sales & use tax rates | Washington Department of Revenue

Tax rate change notices. See current and past notices about changes to city and county sales tax rates. Tax rate charts. Tax Rate Charts show how much sales tax is due based on the amount of a sale. The rate charts range from 7.0 percent to 20.5 percent and calculate up to a $100 sale. Determine the location of my sale boxing punch bag stand ukResidents of Clark County pay a flat county income tax of 2.00% sales tax rate in clark county nevada 2018 on earned income, in addition to the Indiana income tax and the Federal income tax.. Nonresidents who work in Clark County pay a local income tax of 0.75%, which is 1.25% lower than the local income tax paid by residents.

Clark County Indiana Treasurer's Office

Monty Snelling, Clark County Treasurer Clark County Government Building 501 E. Court Avenue Room #125 Jeffersonville, IN 47130. P 812.285.6205. Email - www.waterandnature.org Office Hours: 8:30 - 4:30, Monday - Friday Closed daily from noon to 1:00 pm for lunchnevada general fund revenue . economic forum december 3, 2018 forecast, 2019-21 biennium . adjusted for general fund repayment approved in section 39 of a.b. 518 (2017)

RECENT POSTS:

- most cheapest thing in louis vuitton

- sale louis vuitton purses

- louis vuitton custom bag

- louis vuitton america online shopper

- louis vuitton pre-owned neverfull bag

- louis vuitton graffiti keepall

- louis vuitton slides fur

- faux gucci crossbody bag images

- st louis furniture outlet stores

- lv damier geant messenger

- men's clutch bags sale

- men's accessories wholesale uk

- lv metis singapore price

- louis vuitton neverfull wristlet strap