As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

![sales tax rate in clark county nevada 2019 Las Vegas Sales Tax Rate 2020/2021 [Nevada] - TownPlasa](https://townplasa.com/wp-content/uploads/2020/05/6869765923_307afdd67c_tax-300x300.jpg)

How to Calculate Nevada Sales Tax on a New Automobile | It ...

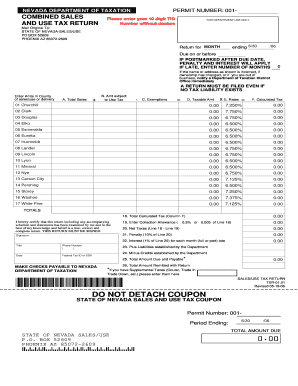

Determine the sales tax rate in your county. There are 17 different sales-tax rates within the state of Nevada, depending on which county you live in. The rates range from 6.85 percent to 8.1 percent. View the Nevada Sales Tax map to determine your tax rate. (See Resources.) lv2 keepallEffective October 1, 2019, all marketplace providers are required to collect tax on behalf of sellers in Nevada if, in the current or immediately preceding calendar year, it had cumulative gross receipts exceeding $100,000 from retail sales made or facilitated to customers in Nevada, or made or facilitated at least 200 separate retail sales ...

Jul 11, 2019 · The Nevada Legislature recently gave county commissions the authority sales tax rate in clark county nevada 2019 to raise quarter-cent sales taxes specifically for education. SUBSCRIBE NOW $1 for 3 months.

nevada general fund revenue . economic forum december 3, 2018 forecast, 2019-21 biennium . adjusted for general fund repayment approved in section 39 of a.b. 518 (2017)

The Clark County, Washington sales tax is 7.70%, consisting of 6.50% Washington state sales tax and 1.20% Clark County local sales taxes.The local sales tax consists of a 1.20% county sales tax.. The Clark County Sales Tax is collected by the merchant on all qualifying sales made within Clark County; Groceries are exempt from the Clark County and Washington state sales taxes

Clark County, NV

The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County. Let's assume an exemption after the adjusted CPI is $1,000 assessed value and the tax rate is $3.50 per hundred of assessed value. To determine the exemption sales tax rate in clark county nevada 2019 value, multiply the $1,000 x the tax rate .035 = $35.00.Clark County, NV

For information on Sheriff Sales, you sales tax rate in clark county nevada 2019 may call (702) 455-5400.Use Tax Information & FAQ's - Nevada

For the most part, Use Tax rather than Sales Tax, applies to property purchased ex-tax outside of Nevada for storage, use or other consumption in Nevada from other than a seller registered in Nevada. Use Tax, applies to mail order, out-of-state, toll-free “800” numbers, purchases made on the internet and other purchases of tangible personal ...Tax rates in Nevada are expressed in dollars per $100 in assessed value. Thus, if your tax rate is $3.25 and your assessed value is $40,000, your total annual tax is $1,300. There are numerous tax districts within every Nevada county. Clark County, for example, lists 112 different tax …

RECENT POSTS:

- hidesign leather laptop bags indiana

- louis ck i saw lisa today's

- michael kors bags outlet portsmouth

- monogrammed canvas wall art

- speedy cash payday loans

- houses for sale in memphis tn 38115

- st louis post-dispatch delivery

- gucci belt uk

- louis vuitton keyring australia

- jordan 1 off white lv

- louis vuitton monogram speedy 25 vs 30

- best buy black friday 2018 deals

- louis vuitton initials

- louis vuitton psd boxers