As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

.jpg)

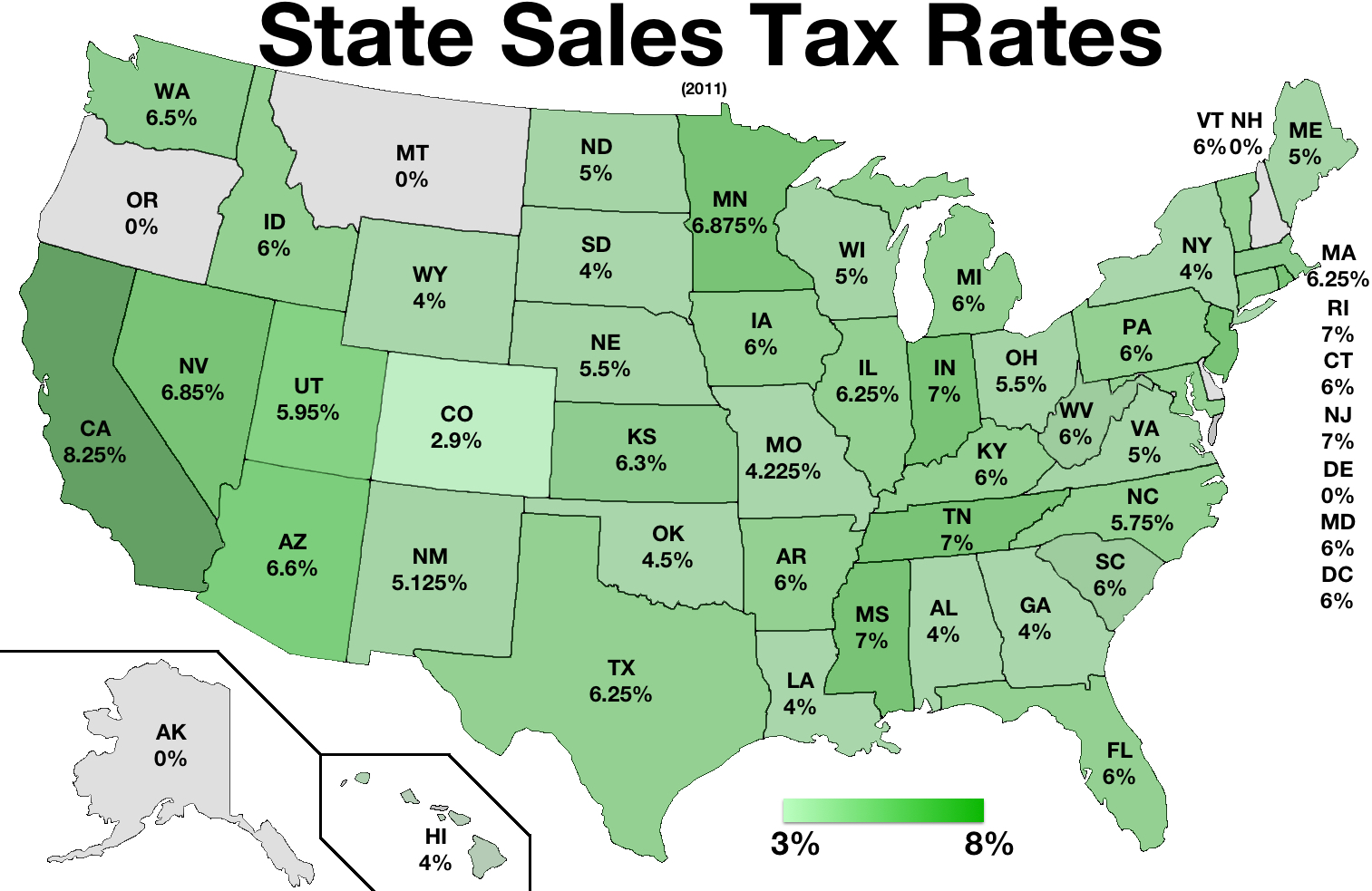

Nevada Income Tax Calculator - SmartAsset

Jan 01, 2020 · Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates …New Rules on Collecting Sales Tax for Remote Sellers. Effective October 1, 2018, remote sellers whose sales in Nevada exceed certain thresholds must collect sales tax. Remote sellers are any sellers, including online retailers, who don’t have a physical presence in Nevada and are not otherwise required to register or collect sales tax in Nevada.

The minimum combined 2020 sales tax rate for Searchlight, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Searchlight sales tax rate …

Jun 06, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%.This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%.The Clark County, sales tax rate…

Nevada Tax Rates & Rankings | Nevada State Taxes | Tax ...

Taxes in Nevada. Each state’s tax code is a multifaceted system with many moving parts, and Nevada is no exception. The first step towards understanding Nevada’s tax code is knowing the basics. How does Nevada rank? Below, we have highlighted a number of tax rates, ranks, and measures detailing Nevada’s income tax, business tax, sales tax, and property tax …Jan 30, 2019 · The District of Columbia’s sales tax rate increased to 6 percent from 5.75 percent. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate …

Las Vegas Sales Tax Rate For Visitors & Locals [2020 ...

Combined Sales Tax Rate for Purchases in Las Vegas. You can see from the table above that the sales tax in Las Vegas is a combination of Nevada state sales tax and Clark County’s sales tax rate nevada sales tax. Las Vegas itself does not have its own sales tax rate. (This sales tax rate …Aug 19, 2018 · Nevada sales tax rate nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax …

Churchill County, Nevada Sales Tax Rate

The sales tax rate nevada Churchill County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Churchill County local sales taxes.The local sales tax consists of a 3.00% county sales tax.. The Churchill County Sales Tax is collected by the merchant on all qualifying sales made within Churchill County; Groceries are exempt from the Churchill County and Nevada state sales …RECENT POSTS:

- lv boite chapeau souple mm review

- on the go lv tote

- gucci wallet bag singapore

- louisville water company louisville ky 40214

- waxed canvas tote bag with zipper

- designer handbags for cheap online

- youtube st louis chess

- gucci signature large hobo bag reviewed

- will iphone 11 pro max be on sale black friday

- adidas nmd r1 sale au

- louis vuitton cherry blossom bucket bag

- do louis vuitton have sales

- louis vuitton price list korea 2020

- louis vuitton zipper handbag