As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

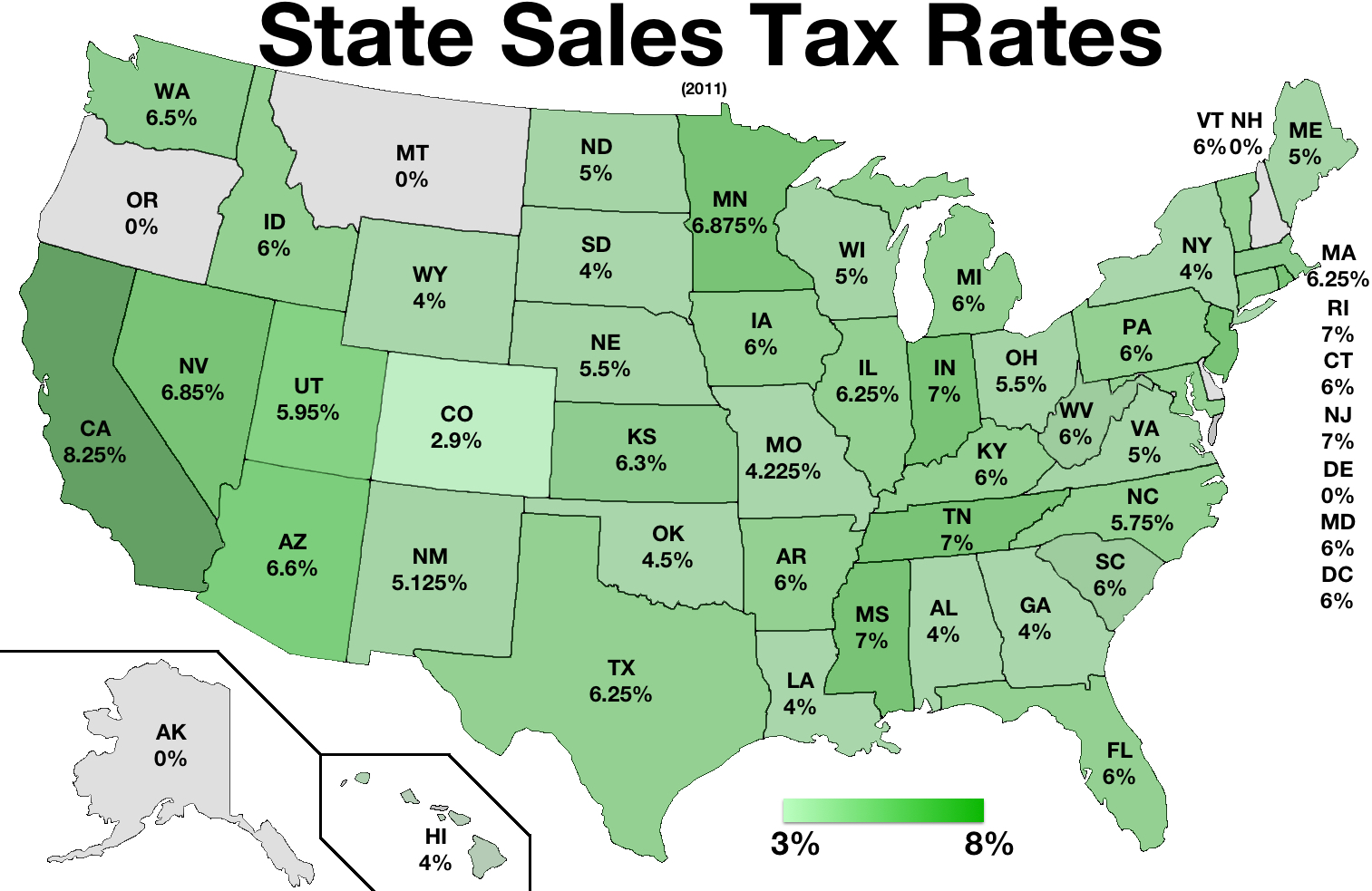

Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada State Department of Taxation Department of Taxation Home Page

The minimum combined 2020 sales tax rate for Nevada County, Arkansas is . This is the total of state and county sales tax rates. The Arkansas state sales tax rate is currently %. The Nevada County sales tax rate …

Current Tax Rates, Tax Rates Effective October 1, 2020, Find a Sales and Use Tax Rate by Address, Tax Rates by County and City, Tax Rate Charts, Tax Resources, The following files are provided to download tax rates …

Annual Property Tax Sale Auction | Nevada County, CA

Tax-defaulted property is scheduled for sale at a public internet auction to the highest bidder at the time fixed for the sale. Typically, the Annual Property Tax Sale Auction is held in November online. You may obtain the list of properties to be offered at the next tax sale …Clark County Sales Tax Rates | US iCalculator

Clark County in Nevada has a tax rate of 8.25% for 2020, this includes the Nevada Sales Tax Rate of 6.85% and Local Sales Tax Rates in Clark County totaling sales tax rates nevada by county 1.4%. You can find more tax rates and allowances for Clark County and Nevada in the 2020 Nevada Tax …State and Local Sales Tax Rates, 2019 | Tax Foundation

Jan 30, 2019 · The District of Columbia’s sales tax rate increased to 6 percent from 5.75 percent. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate …The Nevada County, Arkansas Local Sales Tax Rate is a ...

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Arkansas has a 6.5% sales tax and Nevada County collects an additional 2%, so the minimum sales tax rate in Nevada County is 8.5% (not including any city or special district taxes). This table shows sales tax rates nevada by county the total sales tax rates for all cities and towns in Nevada County ...Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …

How 2020 Sales taxes are calculated in Washoe Valley. The Washoe Valley, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 8.265% Every 2020 combined rates mentioned above are the results of Nevada sales tax rates nevada by county state rate (4.6%), the county rate (3.665%). There is no city sale tax …

RECENT POSTS:

- authentic coach bag number lookup

- wide belt sanders woodworking

- lv hobo bag monogram

- black suede handbags with embroidered roses

- macy's furniture outlet las vegas

- louis vuitton designer shirts

- vegan leather tote bag zipper

- louis partridge and millie bobby brown live

- louis vuitton speedy bandouliere size comparison

- bloomingdale's outlet online store

- cheap dresses for sale in pretoria

- louis vuitton official site indianapolis

- st louis cardinals tickets ticketmaster

- louis vuitton felicie pochette black