As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

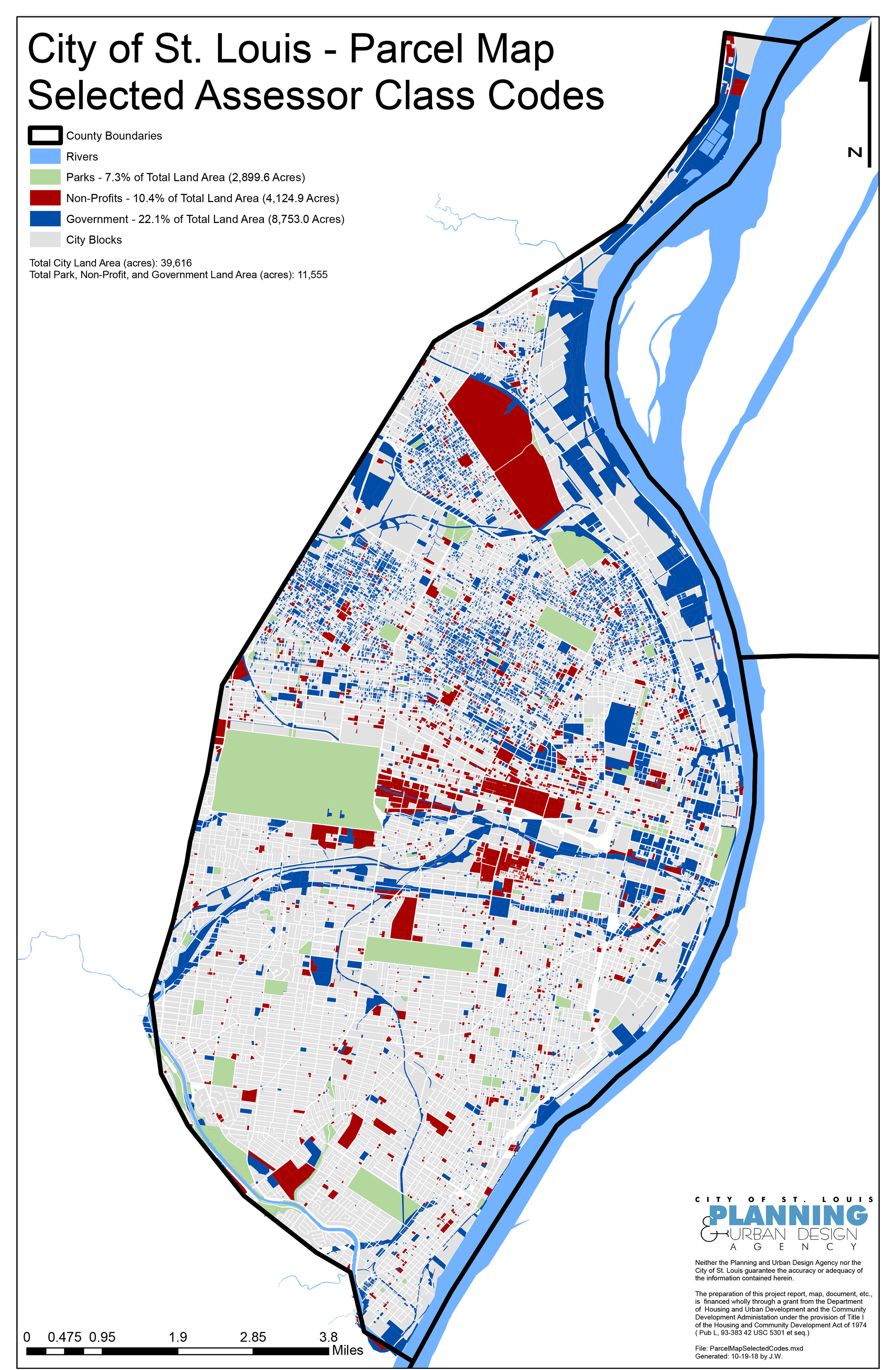

Sales Tax Rates within the City of Chesterfield: Zip Code 63017: MO State: 4.225%: St. Louis County: 3.513%: City of Chesterfield: 1.000%: Total Sales Tax Rate

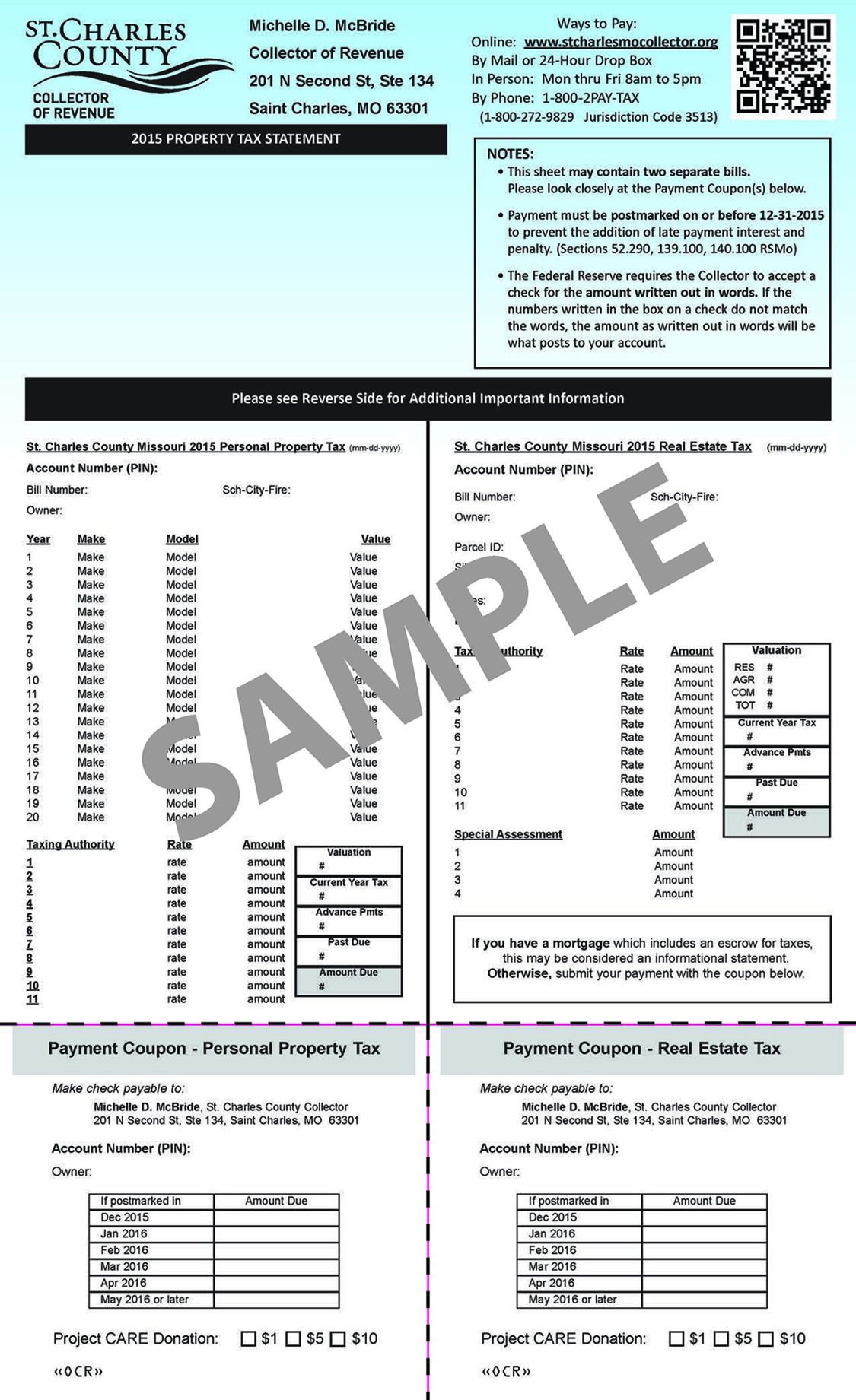

Property Tax Refund | Minnesota Department of Revenue

If you're a Minnesota homeowner or renter, you may qualify for a Property Tax Refund. The refund provides st louis county real estate tax information property tax relief depending on your income and property taxes.Property search tips and tricks; Internal or government users only: Manage my login; Frequently asked questions and glossary; Pay your property taxes online. Paying your property taxes is still provided through US Bank. To access the payment portal: Visit property tax and value lookup. Search for your property. Choose the correct parcel under ...

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real st louis county real estate tax information estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Saint Louis County Home | Saint Louis County Land Explorer Parcel Tax Lookup Contact Information: St. Louis County Auditor (218)-726-2383 (Ext.2)

Real Estate Tax | Lake Saint Louis, MO

City real estate tax is separate from St. Charles County real estate tax and other annual assessments due to Community Associations. The City mails real estate tax bills in late November to the owner and address provided by St. Charles County unless the bill is requested by a lender/real estate st louis county real estate tax information tax …We have helped business owners across the St. Louis area save thousands — even hundreds of thousands — of dollars in annual taxes through commercial property tax appeals. Commercial Property Tax Appeals. The county reassesses real estate property values in odd-numbered years. Assessors use one of three methods to determine the fair market ...

TAX ASSESSOR – COLLECTOR | Mississippi's Hancock County

Hancock County Tax Assessor Post Office Box 2428 Bay St. Louis, MS 39521-2428 . Tax Assessor/Collector Annex Office 854 Highway 90, Suite C Bay St. Louis, MS 39520 (228) 467-4425 . Tax Assessor/Collector Satellite Office 18335 Highway 603 Kiln, MS 39556 (228) 255-8746 / (228) 255-8747. GIS / Mapping (228) 467-0130. Real Property Appraisal (228 ...May 26, 2019 · If you own a home or business in St. Louis or St. Louis County, you may have received a letter about your property's value going up. Residential property values on …

RECENT POSTS:

- real louis vuitton bag neverfull

- high quality replica designer shoes china

- louis vuitton graceful pm sale

- louis vuitton nail plates

- nike shoes cheapest price

- louis vuitton bag lv upside down

- waist travel bags for men

- ikea off white bag price

- gucci marmont bag green

- cleveland browns belt buckle

- how do you know if my louis vuitton is fake

- louisville tourism board of directors

- genuine leather wallet clutch

- cosmetic bags wholesale usa