As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

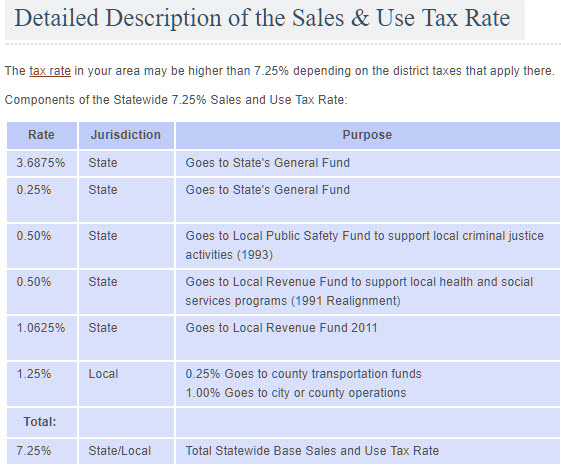

Of course, while all SSUTA’s member states follow some basic guidelines, their specific tax laws are all different, and so you need to know the specifics of each to ensure you’re in full compliance everywhere you make sales. Nevada Sales Tax Rates. The state sales tax total sales tax rate nevada turbotax rate in Nevada is 4.6%.

Jul 01, 2020 · With local taxes, the total sales tax rate is between 6.000% and 8.500%. Florida has recent rate changes (Sat Feb 01 2020). Select the Florida city from the list of popular cities below to see its current sales tax rate.

If your cost is less than the sales price, you have a capital gain. Your long-term gain will be taxed at 0%, 15%, or 20% depending on your income. If you have a short-term gain it will be taxed as ordinary income using your marginal tax rate. If your cost exceeds your sales price, you have a capital loss.

Jul 29, 2020 · When calculating the sales tax for this purchase, Steve applies the 4.6% state tax rate for Nevada plus 3.55% for Clark county’s tax rate. At a total sales tax rate of 8.15%, the total cost is $378.53 ($28.53 sales tax). Out-of-state Sales. Nevada businesses only need to pay sales tax on out-of-state sales if they have nexus in other states.

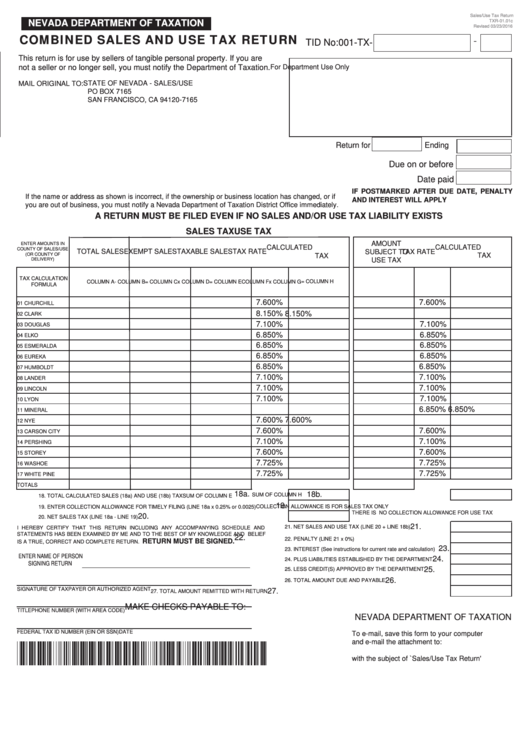

The Department's Common Forms page has centralized all of our most used taxpayer forms for your convenience. The documents found below are available in at least one of three different formats (Microsoft Word, Excel, or Adobe Acrobat [.PDF]).

Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates for every county and the largest cities in the state.

Each state with a sales tax has a statewide sales tax rate. States use sales tax to pay for budget items like roads and public safety. The state sales tax rate is the rate that is charged on tangible personal property (and sometimes services) across the state. These usually range total sales tax rate nevada turbotax from 4-7%. For example, the state rate in New York is 4% while ...

The sales tax deduction affords taxpayers the opportunity to reduce their tax liability when they claim sales taxes that they paid on purchases during the course of the 2019 tax year.

Sales Tax Calculator

Sales tax: $5.00. Cost/Price before ST: $100.00. Total Cost/Price including ST: $105.00. In case of an item with a final price of $112 that includes a sales tax rate of 7% this application will return these results: Sales tax: $7.33. Cost/Price before ST: total sales tax rate nevada turbotax $104.67. Total Cost/Price including ST: $112.00. Sales tax definition and ratesRECENT POSTS:

- nike outlet store portland or

- louis vuitton bags first copy price in indiana

- louis vuitton montaigne bag

- louis vuitton lockit vertical bagger

- louis vuitton viva cite gm size

- straps for louis vuitton handbags

- at louis vuitton

- st louis cardinals 30 man roster 2020

- louis vuitton grey monogram scarf

- louis vuitton iphone x case amazon

- dkny mini leather backpack/handbag with removable straps and top handle

- women's winter boots clearance sale canada

- atlanta louis vuitton store looted

- lv monogram cross body bag