As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

California Documentary and Property Transfer Tax Rates

California Documentary and Property Transfer Tax Rates ... COUNTY: RECORDER ADDRESS: CONTACT: COUNTY TAX Per $1,000: CITY TAX Per $1,000: TOTAL Per $1,000 Property Value: ESCROW FEES : TITLE ... Nevada: 950 Maidu Avenue Nevada City, CA 95959 Map: 530.265.1221. County …Sales & Use Tax Guide for Small Businesses

Mar 02, 2017 · Sales what is the sales tax in nevada county california tax is a tax you charge to customers when they purchase products or services from you. As a business owner or seller, you are responsible for calculating, collecting, reporting, and remitting sales tax to the appropriate state and local tax authorities. Use tax is a tax … cheap queen size bedroom sets with mattressSome local jurisdictions do not impose a sales tax. Yes. California: what is the sales tax in nevada county california 7.250% Note that the true California state sales tax rate is 6%. There is a statewide county tax of 1.25% and therefore, the lowest rate anywhere in California is 7.25%. We have listed the combined state/county rate as the state rate to eliminate confusion. 0% – 3.25%. Yes ...

Sales & Use Tax | Placer County, CA

The sales tax is assessed as a percentage of the price. Retailers are taxed for the opportunity to sell tangible items in California. Exceptions include services, most groceries and medicine. Retailers typically pass this tax along to buyers. Components. The “base” sales tax rate of 7.25% consists of several components. The main increment ...California City Documentary and Property Transfer Tax Rates Governance: Per $1000 Rev&Tax Code Per $1000 General Law PropertyValue Sec 11911-11929 PropertyValue or Chartered City Rate County Rate Total ALAMEDA COUNTY $ 1.10 $ 1.10 ALAMEDA Chartered $ 12.00 $ 1.10 $ 13.10 ALBANY Chartered $ 11.50 $ 1.10 $ 12.60 BERKELEY Chartered 1.5% for up to ...

Nevada County, California Economy

Tax Rates for Nevada County - The Sales Tax Rate for Nevada County is 7.8%. The US average is 7.3%. - The Income Tax Rate for Nevada County is 9.3%. The US average is 4.6%. - Tax Rates can have a big impact when Comparing Cost of Living. Income and Salaries for Nevada County - The average income of a Nevada County resident is $32,117 a year ...Nevada County Assessor's Office - Nevada, CA (Address ...

The Nevada County Assessor's Office, located in Nevada, California, determines the value of all taxable property in Nevada County, CA. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to …Premium Bid Method: In a public oral bid tax sale where Nevada County California is utilizing the Premium Bid Method the winning bidder at the what is the sales tax in nevada county california Nevada County California tax sale is the bidder who pays the largest amount in excess of the delinquent taxes, delinquent interest, and fees. The excess amount shall be credited to the county general fund.

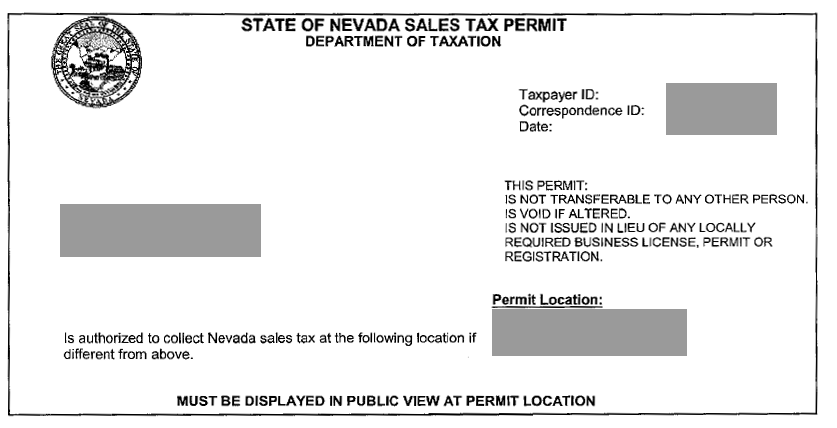

Local Business Tax in Nevada County, California

A Nevada County, California Local Business Tax can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a Nevada County, California Local Business Tax.RECENT POSTS:

- louis vuitton airpods pro cover

- louis vuitton x supreme denim jacket

- louis vuitton bracelet dhgate

- louis vuitton belt real price

- supreme louis vuitton belt

- lv neverfull diaper bag

- preloved chanel wallet

- wallet for euros

- louis vuitton designer 2019

- vintage clutch bags australia

- macy's furniture outlet new jersey location

- macys queen sheet sets sale

- denim louis vuitton sandals

- best buy lv nv