As many of you ask me for most of the Louis Vuitton bag prices on our Instagram

- PM (29.0 x 21.0 x 12.0 cm (length x height x width )) [Price $1,310]

- MM (31.0 x 28.5 x 17.0 cm (length x height x width) ) [Price $1,390]

- GM (39.0 x 32.0 x 19.0 cm (length x height x width )) [Price $1,470]

The Louis Vuitton Neverfull materials are Monogram, Epi Leather, Damier Ebene and Azur Canvas.

The prices for Monogram, Canvas and Damier Ebene are the same but for the Epi Leather, LV Giant and Monogram Jungle it changes. In the table below you will find the prices for every LV Neverfull bag.

NEVERFULL MM MONOGRAM JUNGLE & Giant Price: ($1,750)

NEVERFULL MM EPI LEATHER DENIM Price: $2,260

NEVERFULL MM EPI LEATHER NOIR Price: $2,090

Best 30 Homeowners Insurance in Baton Rouge, LA with ...

Shop Homeowners Insurance in Baton Rouge, LA today & save hundreds! Get access to agents in your neighborhood, coupons, affordable rates, reviews, hours, contact info & free quotes within minutes.Early Shopping – Get a Farmers Auto quote at least 7 days before the policy goes into effect and you’ll receive this rate discount. Homeowner – If you own your home, you could save on your auto insurance.. Pay In Full – Choose to pay your entire term premium at one time and we’ll reduce your rate.. Transfer – Switch to Farmers from another carrier without a gap in coverage and we ...

Apr 30, 2020 · Homeowners insurance isn’t necessarily cheap, especially if you’re seeking out comprehensive coverage, and adding a solid auto plan to the overall bill might seem like a less than favorable prospect. But don’t panic, because there’s a clear solution.

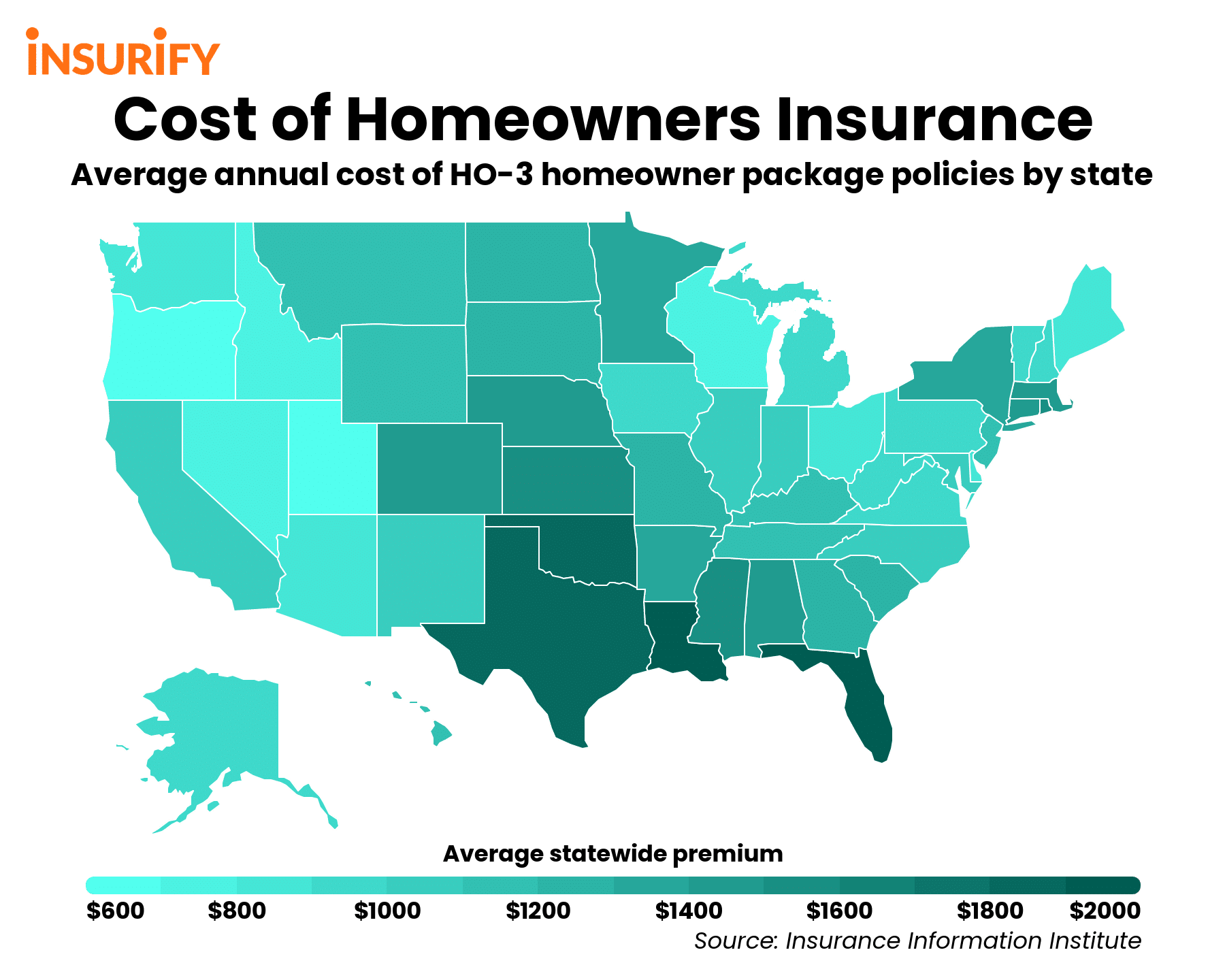

Nov 06, 2020 · Cheapest ZIP Codes in New Orleans for Home Insurance. New Orleans has faced its fair share of natural disasters, but cheapest louisiana homeowners insurance taking steps to minimize risk factors can go a long way in protecting homes and belongings against loss.. Like property costs, home insurance varies in price from city to city. Pricing is determined by ZIP code–specific variables, such as the volume of claims filed nearby ...

Best and Cheapest Homeowners Insurance in Louisiana

New Orleans is one of the most expensive cities to purchase homeowners insurance in Louisiana.Monthly premiums in New Orleans average over $3,000. Baton Rouge offers slightly less expensive homeowners insurance rates, but premiums can still cost up to $3,000 per month.If you’re looking to insure a home in New Orleans or Baton Rouge, investing in a homeowners policy with a …FM Agency Group | Insurance broker

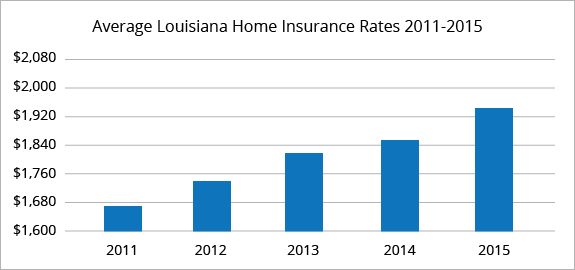

Your trusted Insurance broker for homeowners, rental propety, commercial buildings, and flood insurance in Louisiana, Mississippi and Alabama. Your Insurance broker to protect what you have. We deliver the protection you need for homeowners, rental property and commercial buildings since 2003.Jan 03, 2010 · By the Louisiana Department of Insurance's calculations, statewide average homeowners rates increased by 3.5 percent in 2007 and 2008, and 4.5 …

Cheap Insurance Shreveport

Cheap Insurance Shreveport Some of that is owed to the fact that a number of casinos and gaming business are located in and around the city. Because of its high property taxes, many residents choose to live on the outskirts of the city and commute in, which can sometimes pose traffic concerns, but all in all the city is a comfortable and easy ...1 Data provided by S&P Global Market Intelligence and State Farm Archive.. 2 Please refer to your actual policy for a cheapest louisiana homeowners insurance complete list of covered property and covered losses. Homeowners insurance provides coverage for damage to your house and other structures on the property where your house is located. It is important to understand, however, that not every possible cause of damage is covered.

RECENT POSTS:

- harga dompet louis vuitton origin

- louis vuitton houston store

- millie bobby brown and louis partridge dating

- mens louis vuitton backpack

- lv store in rodeo drive

- bloomingdale's outlet orange county

- red heart shaped bags

- wallet for sale philippines

- clutch louis vuitton original

- clearance patio furniture sets home depot

- six flags hours of operation st louis

- st louis cardinals baseball news updates

- home decor shops in st louis montgomery

- louis vuitton stock ticker symbol